Large food and beverage establishments are required to make annual reports to the Internal Revenue Service concerning receipts from food or beverage operations and tips reported by employees. In certain circumstances, the employer is required to allocate amounts as tips to employees. See IRS Publication 539 for details.

Generally, an employer must allocate tips among employees who receive tips only if the total tips reported to the employer during any payroll period are less than 8% of the employer's gross receipts for that period. The amount allocated is the difference between the total tips reported by employees and 8% of the gross receipts, other than non-allocable receipts (those for carry-out sales and receipts with a service charge added of 10% or more).

Note: The amount allocated is for information purposes only and income or social security taxes are not to be withheld on that amount.

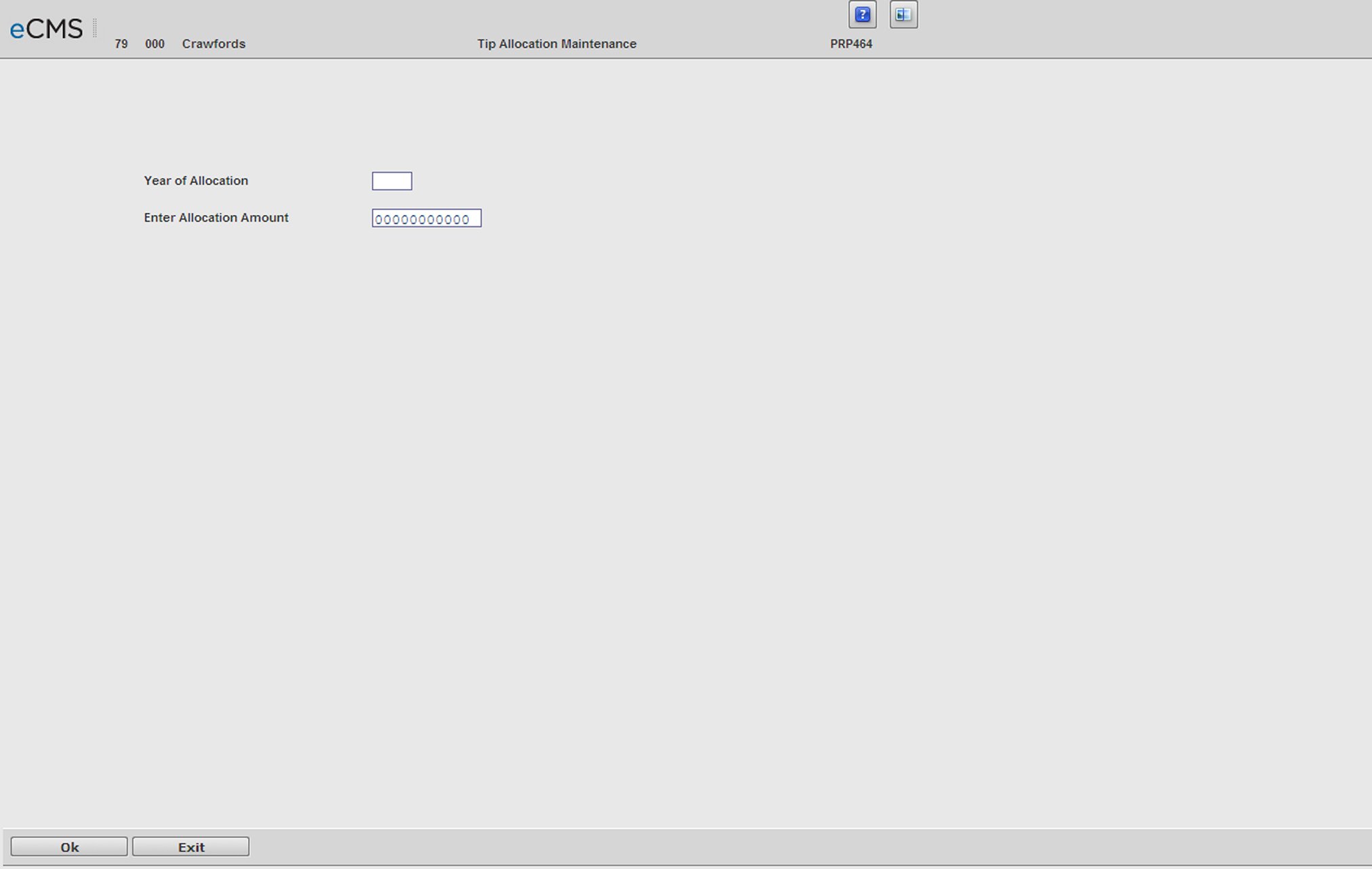

Tip Allocation Selection screen

Year of Allocation

Enter the year applicable to tip earnings allocation

Enter Allocation Amount

Enter the total amount of tips to be allocated among qualified employees. The amount is determined by multiplying the total qualified gross receipts from the provision of food and/or beverages for the year times 8% (or your lower rate granted by the Internal Revenue Service).

The allocation is automatically made for all employees whose Tips option has been selected in their Employee Master (General 2 tab). The tips entered will be allocated to each qualified employee in the same ratio as the employee's hours worked for the year to the total qualified employee hours worked for the year. The tips allocated will display on the W2 form for the employee.

The allocated tips are not considered income to the recipient. They are merely for informational purposes only. Actual tip income received, however, is taxable income.

Click to process these entries and return to the Main Menu. |

|

Click to return to the Main Menu without saving changes. |