This option prints the W2 forms required for annual employee tax records and government reporting using the W2 Forms Selection. This option can record W2 information on magnetic media (diskette or tape) and prints combined W2 Forms or separate W2 Forms for federal and each state or local entity. Contact CGC Customer Support if you need information on ordering W2 Forms.

Before printing the forms, check the W2 Register carefully to see that all employees show a social security number and that all totals balance to your control numbers. You might also want to print out the Employee Master File and verify that employee records contain correct employee addresses.

It is suggested that you order twice the amount of W2 forms you expect to use, to allow for unexpected problems. If you have any questions, call CGC before running this or subsequent procedures on this menu.

This option also uses the year end files created by the Prepare Year End Payroll Files option.

Note: To file W2 information on disk, you must use a 1D disk initialized with the 128-byte/sector FORMAT (not FORMAT2).

To download to PC diskettes, the 5.25 or 3.5 diskettes must be in MS-DOS format. The system supports the 3.5 diskette format for Federal reporting only. It does not support the 3.5 diskette format for individual state reporting.

To file W2 information on tape, you must use a ½ magnetic tape in the unpacked mode on 9 track tape. The recording density is 1600 characters per inch, using standard IBM OS header and trailer labels, and 1 block of logical records.

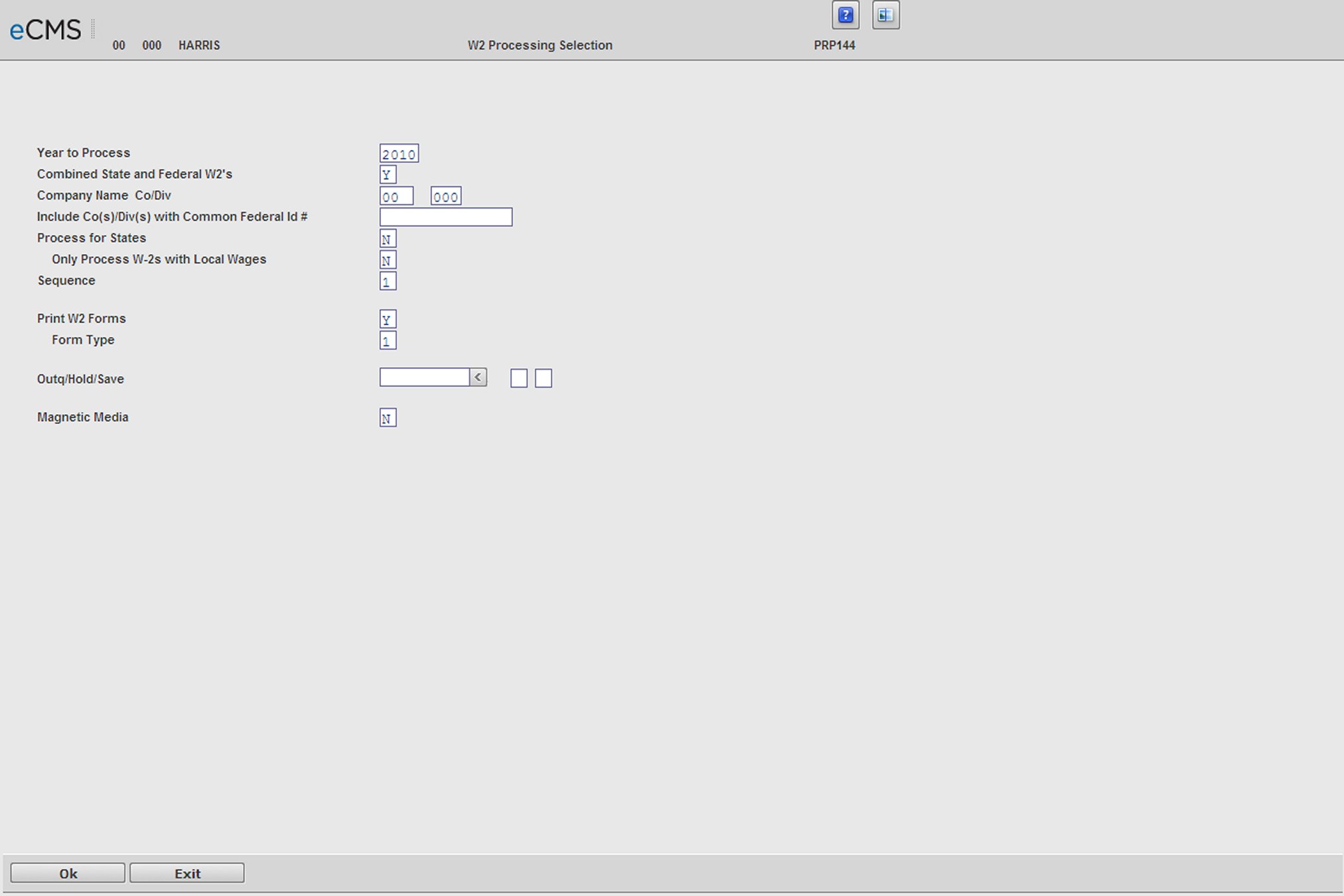

Year To Process

Enter the payroll year to be processed.

Combined State and Federal W2's

Y |

This is a combined run for federal and state W2's. All states will be included in this run. This option should only be selected if you have only one payroll state for the company being processed. |

N |

This is a federal only or single state run. |

Process All Companies With (Entered) Federal ID Number

To process multiple companies, the companies must have a common federal identification number and employees must be setup in all companies. To process W2 forms for multiple companies, enter their common federal identification number.

Wages, Tips, Other Compensation to Include

A |

All Earnings, including non-taxable adjustments and non-taxable travel pay (subsistence) will be included in the Wages field of the W2. |

T |

Only Taxable Earnings will be included in the Wages field of the W2. |

The decision to include all earnings or taxable earnings only should be based upon the type of payments made to employees through the payroll system, your understanding of federal requirements, or the advice of your certified public accounting firm.

Process For States

Y |

The W2 Forms State Processing Selection screen displays when you click OK |

N |

The W2 Magnetic Media Detail screen displays when you click OK. State selection will be by-passed. |

Only print W2's with Local Wages

Y |

Only print a W2 Form for employees with local wages. |

N |

Print W2's for all employees. |

Form Type

Enter one of the following to indicate the type of W2 form you will be using.

1 |

Single-over/under format. |

2 |

Side by side format. |

Magnetic Media

N |

Magnetic media will not be processed at this time. |

F |

You will be processing federal magnetic media. |

S |

You will be processing state magnetic media. |

If you entered an F or an S, one of the magnetic media initialization screens will be displayed when the balance of your selection criteria is complete

Use Current Year Defaults

Y |

Use the current Year defaults as specified in you Company's default setup. |

Restore Media Type

1 |

Save files to diskette. |

2 |

Save files to tape. |

Device ID

Enter the name of the diskette or tape drive.

Print W2 Forms

Y |

Print W2 forms. The system operator will be prompted to load the W2 forms when the balances of your selections are complete |

N |

Only magnetic media processing will occur. |

Click to process these entries.

|

|

Click to return to the Main Menu without saving changes. |

W2 State Processing Selection screen

State

Enter the states to process. If an employee paid income tax in more than one state, a W2 is printed for each state. The employee's federal data is repeated on each form.

Local Codes

If W2 forms are to be printed, you may enter only one local code per state. If an employee paid income tax in more than one local within a state, you must print a separate run for each state/local combination.

If you are processing only magnetic media, you may, in the case of some states, be allowed to select more than one local. Read the instructions you receive from your taxing authorities carefully.

State Specific Tax Number

Enter the tax identification number assigned to your company by each state entered. This number is not verified by the system.

Click to process these entries. The name of each state entered will display on the screen for verification. If you note any errors, correct them at this time. |

|

Click to return to the Main Menu without saving changes. |

|

Click to process magnetic media. If you are not processing magnetic media, you are ready to print W2 forms. The system operator will be prompted to load the forms. If you are processing magnetic media for Federal, the following Mag Media detail screen will display. If you are processing for State, then a similar screen will display. |

|

Click to return to the W2 Forms Selection screen without saving changes. |

W2 Magnetic Media Detail screen

Send File Information To

Enter the name and address of where the W2 report is to be mailed.

Your company name and address displays if you stated the Transmitter is the same as the employer. All information must be left-justified.

Transmitter Federal EIN

Enter the transmitter's Federal Employer Identification Number (EIN).

Transmitter Same as Employer

Y |

The transmitter is the Employer. |

N |

The transmitter is not the Employer. |

Copy Preference

Enter your media preference if you want the government to return to you a report listing your W2 information. Enter one of the following codes:

F |

Microfiche |

M |

Microfilm |

P |

Paper |

N |

None |

Employee Master Name Code

F |

Employee First Names will be printed first on the W2s. |

S |

Employee Last Names will be printed first on the W2s. |

Preferred Method of Problem Notification

Select the method by which you wish to receive these notifications - electronically or by U.S. Mail.

1 |

e-Mail/Internet |

2 |

U.S. Postal Service. |

Media Type

Enter one of the following codes to indicate the type of media on which you will be filing:

1 |

Diskette |

2 |

Tape |

3 |

PC Diskette (5.25 or 3.5 are both supported). If you select this option, you should review the Download to Diskette instructions at this time (see below). |

3rd Party Sick

Third party sick pay (3PSP) is a disability insurance benefit that provides employees with partial or full wage benefit payments while on long-term medical leave. The payments are not made through the employer, but through an insurance company, union plan, or a state temporary disability plan.

Under the IRS Code, Disability "Sick Pay" benefits, third party sick pay benefits may be included in the gross income of insured members and may be subject to tax if the employer pays part or all of the premium for the coverage. The extent to which benefits are taxable is based on the portion of the premium that is paid by the employer.

Any portion of sick pay paid by a third party that is attributable to the employee’s own premium contribution is not wages and is not subject to withholding. However, when premium contributions are made with pre-tax dollars under the employer’s cafeteria plan and deferred from taxation, then any sick pay paid by a third party to the employee is subject to tax withholding.

Taxes Paid

Enter the taxes paid to date to reporting agency (Federal or State).

Kind of Employer

Select one of the following from the drop-down list:

Federal Government

State and Local Government

Tax Exempt

State and Local Tax Exempt

None Apply

Payment Year

Enter the year this media report covers.

Device Name

Enter the device name assigned within your system to the diskette or tape drive to which the magnetic media will be saved.

Click to process these entries. If you opted to print W2 forms, they are processed at this time.

|

|

Click to return to the Main Menu without saving changes. |

Download to PC Diskette

If you have requested to have the ability to download W2 information to a PC diskette, you should have received a diskette containing the programs required to perform this function using your PC.

The PC that you intend to use for the file transfer must have the RTOPC command residing in the PCS directory. To confirm the presence of this command, change directories and use the DIR command to display a list of file names.

In addition, the PC must be running PCS Organizer™ prior to selecting the W2 Forms Option. If the RTOPC command is not present, or you do not know how to run PCS Organizer™, see your system administrator or call a CGC Technical Support representative for assistance.

The diskette to be downloaded to must be in the DOS format. The size and density of the diskette is dictated by the taxing authority.

To load the PC Support file transfer programs from the CGC diskette, please follow these instructions:

1. Place the diskette in the appropriate diskette drive.

2. Enter the following DOS command:

COPY X:*.* C:\PCS

where X: is your diskette drive name.

You should receive a message stating two (2) files were copied.

3. Remove the CGC program diskette and, using the same PC, take the appropriate steps to select the W2 Forms. When the W2 Forms Option is complete, your W2 information is downloaded to your PC hard drive.

To transfer the W2 information file to a DOS formatted diskette, perform the following steps:

1. Insert a formatted diskette in the appropriate disk drive.

2. Label x:W2REPORT (this names the diskette W2REPORT)

3. Enter the following DOS command:

COPY C:\PCS\W2DKTFED X:W2REPORT

where X is your diskette drive name.