This menu option is designed to keep your tax tables current by downloading updated tax tables from the CGC website. When installed, the only maintenance necessary will be the following:

1. Cross reference your current tax codes with those used by this application. By using cross-references, it will not be necessary for you to change your current code setup. During processing, eCMS will note any Custom Status code entered and assume the eCMS Status code to which it has been referenced. After these cross-references have been set up, the table can be modified should it become necessary.

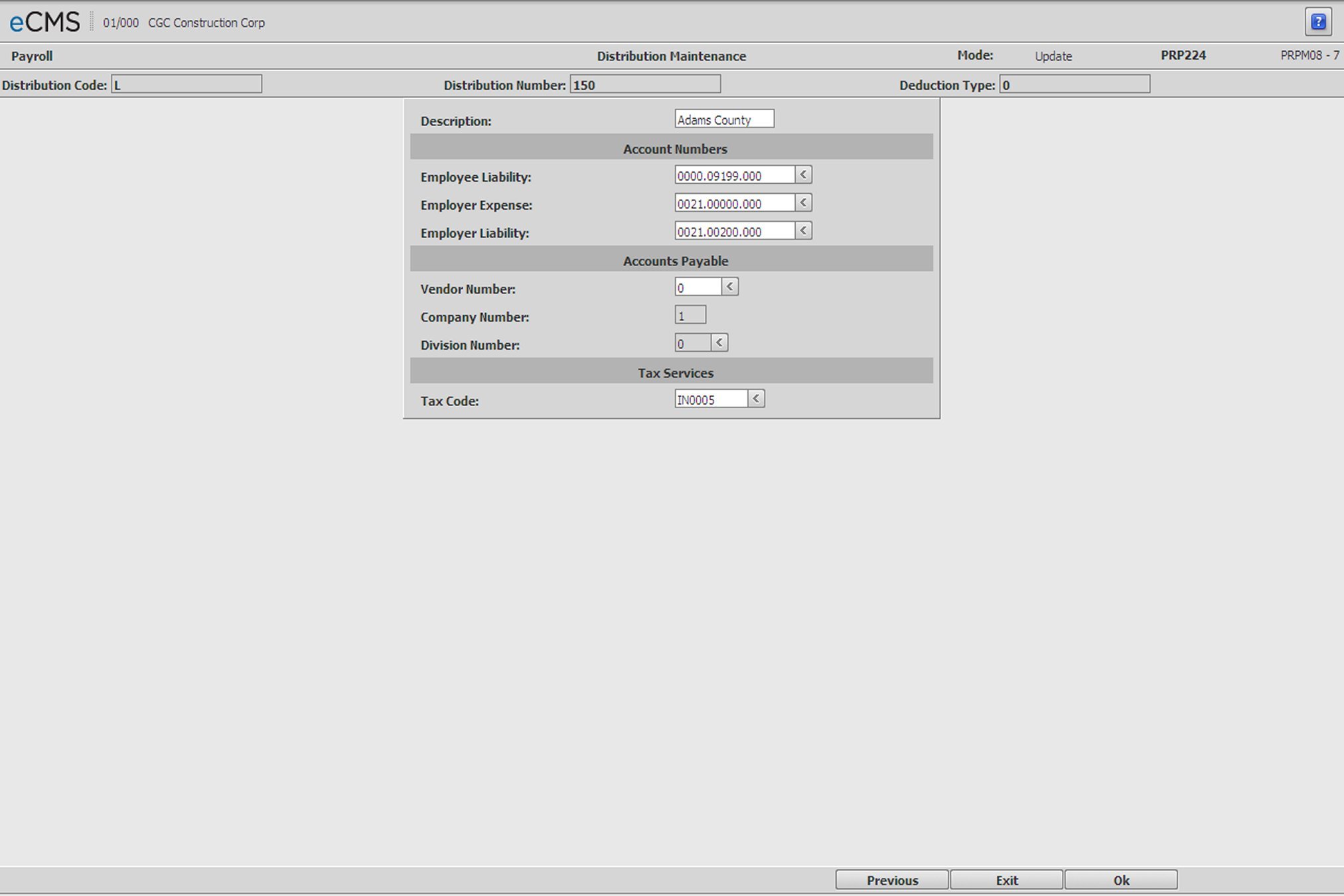

2. Update your Distribution Master “Local” records with the Tax codes from the Cross-reference table. Each Distribution Master “Local” record must have an entry in this field.

3. Periodically download the updated Tax Table file from the CGC website, and run the Tax Table Update procedure available on the Payroll File Maintenance menu. This procedure will pull the downloaded file into your AS400 production tables.

It will be necessary to associate each of your Distribution Master “Local” records with the Tax Codes identified in the Cross Reference table.

Click the Tax Code prompt and select from the list. In the graphic above, we selected Indiana Local IN0005. In our Cross Reference table (see below) this Distribution Master will reference ADAMS COUNTY RES 1.124%.

Click to process these entries and return to the Distribution Master Selection screen. |

|

Click to return to the Main Menu without saving changes. |

|

Click to return to the Distribution Master Selection screen without saving changes. |

Tax Table Cross Reference screen

After you make modifications to this table, you will be given the option to generate updated tax tables. You may choose to do so immediately, or wait for a later date.

eCMS Status - These are the codes the system will use during processing.

Custom Status - These are the codes the Customer currently uses. When eCMS sees a Custom Status code, it will use the associated (cross-referenced) eCMS Status code during processing.

Tax Code - These are the codes you will use when you update your Distribution Master records. During processing, the system will use this code to identify records in the tax table.

Position To: Positions the Cross-reference table on a two character State abbreviation.

Cross Referencing

To cross-reference your status codes with those used by the system, place the cross-referenced code in the table adjacent to the eCMS code it will reference.

1. Use the Vertical scroll bar, or the Position to button, to locate the codes you wish to cross-reference.

2. Move the cursor over the Chg field adjacent to the Tax Code that your Custom Status code will be referencing.

3. Using the mouseover, enter a C in the Chg field, and click OK.

4. In the popup window, enter your Custom code in the field provided and click OK.

5. Your Custom Status code will appear embedded in the table next to the eCMS Status code it references.

To finish and save

1. Click EXIT to save your work.

2. A prompt will display asking, “Do you want to modify the Tax Tables?”.

3. If you don’t wish to modify your tax tables at this time, enter an N and click EXIT to return to the Main Menu.

4. If you do wish to modify your tax tables at this time, enter a Y.

- or -

5. Click EXIT to return to the Main Menu without processing these entries.

Tax Calculation

All Tax Tables downloaded through this procedure are Annual tax tables (i.e. they use a Pay Frequency of “AN”). The tax calculation process is as follows:

1. The system will obtain the employee’s Pay Frequency from the Employee Master.

2. It will then check for a tax table set up with a Pay Frequency of “AN”.

3. If found, the tax amount from the “AN” Tax Table is divided according to the employee’s Pay Frequency.

4. If not found, the system will locate the tax table you have set up for the employee’s Pay Frequency, and process as it has in the past.