Process Exempt Third Party Sick Pay

This topic explains how you can process third party sick pay that is exempt from FICA and Medicare but not exempt from state and federal taxes.

To process exempt third party sick pay

1. On the Main Menu, click Payroll, select File Maintenance, and then click Distribution Master.

Distribution Master Selection screen

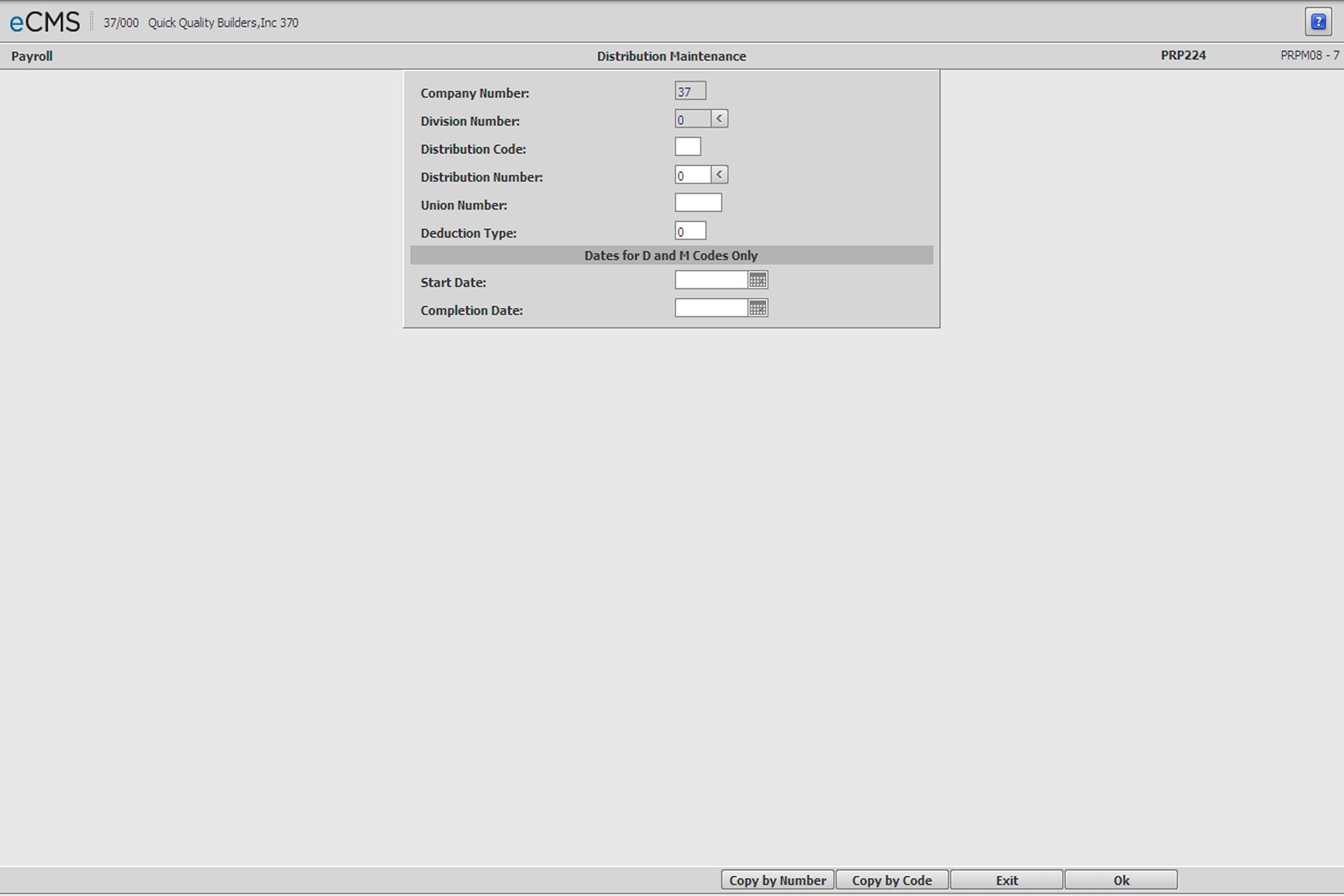

2. On the Distribution Maintenance screen, populate the fields as follows:

a. In the Code field, enter D to create a new taxable code.

b. In the Distribution Number field, enter the appropriate code number that you want to assign to this distribution.

c. In the Start Date field, enter the appropriate start date.

d. In the Completion Date field, select the appropriate completion date, and then click OK.

Distribution Master Detail screen

3. On the Distribution Maintenance detail screen, specify the appropriate distribution information, and then click OK to save changes and to return to the Distribution Master Selection screen.

4. Click Exit to return to the Payroll File Maintenance menu.

5. From the File Maintenance menu, select Employee Maintenance.

Employee Master Selection screen

6. On the Employee Maintenance screen, select the appropriate employee, and then click Employee Data.

Employee Master - Employee Data General screen

7. On the Employee Maintenance detail screen, clear the Subject to FICA field, and then click OK.