This procedure should be used when it becomes necessary to electronically transfer an itemized list of Child Support deductions to a vendor. Previously, the EFT (Electronic File Transfer) sent for each vendor consisted of a one line, lump sum transfer. While this remains true for all other disbursements in the EFT, Child Support deductions are now listed individually with their amounts included in the total displayed for the vendor.

Following are the steps necessary to set up a Child Support EFT.

Edit the Child Support Deduction record

Access the record used for Child Support in the Payroll Distribution Master.

Confirm that the “Invoice by Employee/Deduction” (Inv by Emp/Ded) option is set to Y.

Confirm that a Vendor Number is entered for the intended recipient of this disbursement. This entry can be made on this record, or on the Employee Master record discussed below.

Edit the Individual Employee Master files

Access the Employee Master records for employees who have Child Support deducted, and complete the following fields that display on the second page.

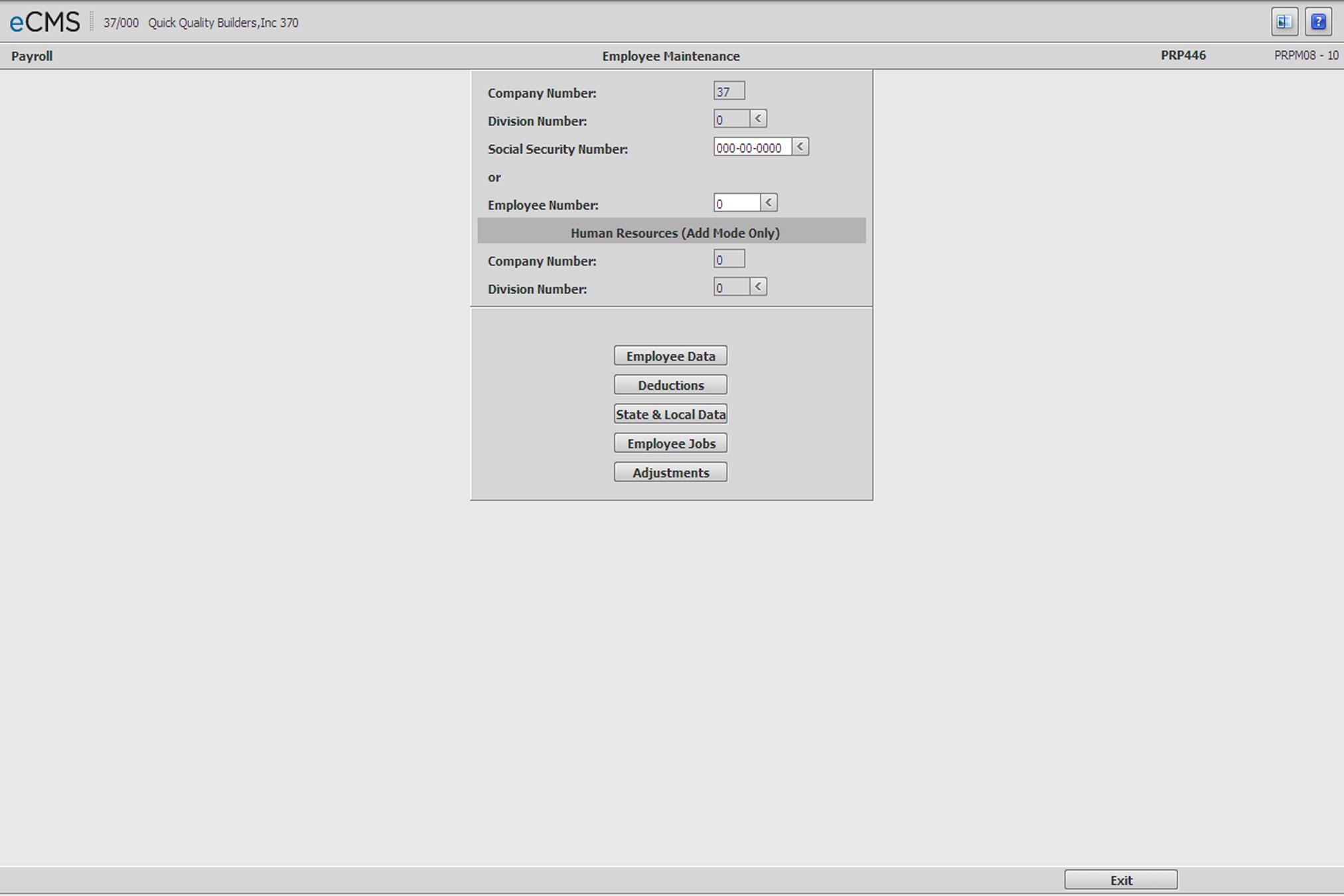

Payroll | Maintenance | Employee Maintenance

Employee Master Selection screen

Enter or click the prompt to select a Employee either by Social Security Number or by Employee Number, and then click the Deductions tab.

Employee Deductions tab | page 2

Employee Master Deductions Detail screen

Case Identifier

The entry in this field should be the identifier supplied by the Courts for the purpose of this Child Support deduction. This field must contain an entry in order to include the Child Support deduction detail record in the EFT. If this field is left blank, the Child Support deduction will still be included in the total for this Vendor, however a line detailing this disbursement will not be generated on the EFT. When this is the case, the total for all the individual detail records will not equal the total listed for the vendor. This could result when a Vendor’s EFT total included disbursements for deductions other than just Child Support, however it is more likely that a Case Identifier was not entered.

Medical Coverage

This field indicates whether the employee also provides Medical Coverage in conjunction with this Child Support deduction. This field must contain a value whenever a Case Identifier has been entered in the previous field. Valid entries include Y and N.

FIPS Code

Enter the Federal Information Process Standard (FIPS) code. The FIPS code refers to the assigned code of the enforcement entity receiving the garnished payments.