This procedure is used to calculate the amount of additional burden to be incurred and posted to the Job Cost, General Ledger, Workers Compensation and Union files, and should only be performed if the Burden Rates have been changed.

Copy Rate Files

The Copy Rate File procedure is used to save existing burden rates before new values are entered. This step is normally done only once.

If this procedure is being run after rate changes have taken place, the retroactive calculation for any updated records will not occur since there will not be a net change between the old and new burden rates. When this is the case, perform the following steps to calculate Retroactive Burden:

1. Change the new rates back to the old rates

2. Run the Copy Rate File option.

3. Revise the burden files with the new rates again.

These steps will need to be run multiple times to calculate retroactive costs at different times, or by union (or class) or groups of unions (classes).

The following files are saved when the Rate file is copied:

PRPBUR |

Burden Allocation file (Percentage Burden) |

PRPMST |

Employee Master |

SYSPRS |

Payroll System Control file (FUTA Burden) |

PRPSTM |

State Master (SUTA Burden) |

PRPTXT |

Tax Table |

PRPUNM |

Union Master file (Union Burden) |

PRPWCR |

Workers Compensation Rate file (W/C Burden) |

There are no processing options for this procedure. By clicking OK on the security screen, the above files will be saved with a prefix of O.

When the Burden Processing procedure runs, the values in the O Burden files are subtracted from the values in the current Burden files to determine the net change in burden rates. The difference (net change) is used to calculate the Retroactive Burden amounts.

Processing

This menu option is used to calculate the amount of additional burden to be incurred and posted to the job cost, general ledger, worker's compensation and union files. The labor cost paid under the old pay rates is used to calculate the incremental amount of the burden. Burden on any incremental amount of pay is calculated when the Create Payroll Work File Option of Retroactive Pay runs.

Only the Union Burden records coded as follows will be processed:

Employer Paid |

= |

R |

Maximum Amount |

= |

0 |

Include in Net |

= |

N |

The system does a net change calculation between the rates saved, using the Copy Rate File procedure, and the rates in the current burden records. After the rate files have been copied, only records that have been updated with new values would show a net change and would subsequently be processed.

Running this procedure multiple times will calculate the burden and posted each time.

To process Retroactive Burden before all final rates are known, copy the rate files after the processing for each group of changes has been completed. This will update the Retroactive Rates with the new values and will eliminate the net change for those records already processed if Burden Processing is rerun. Only Burdens that have a net change will be affected during processing.

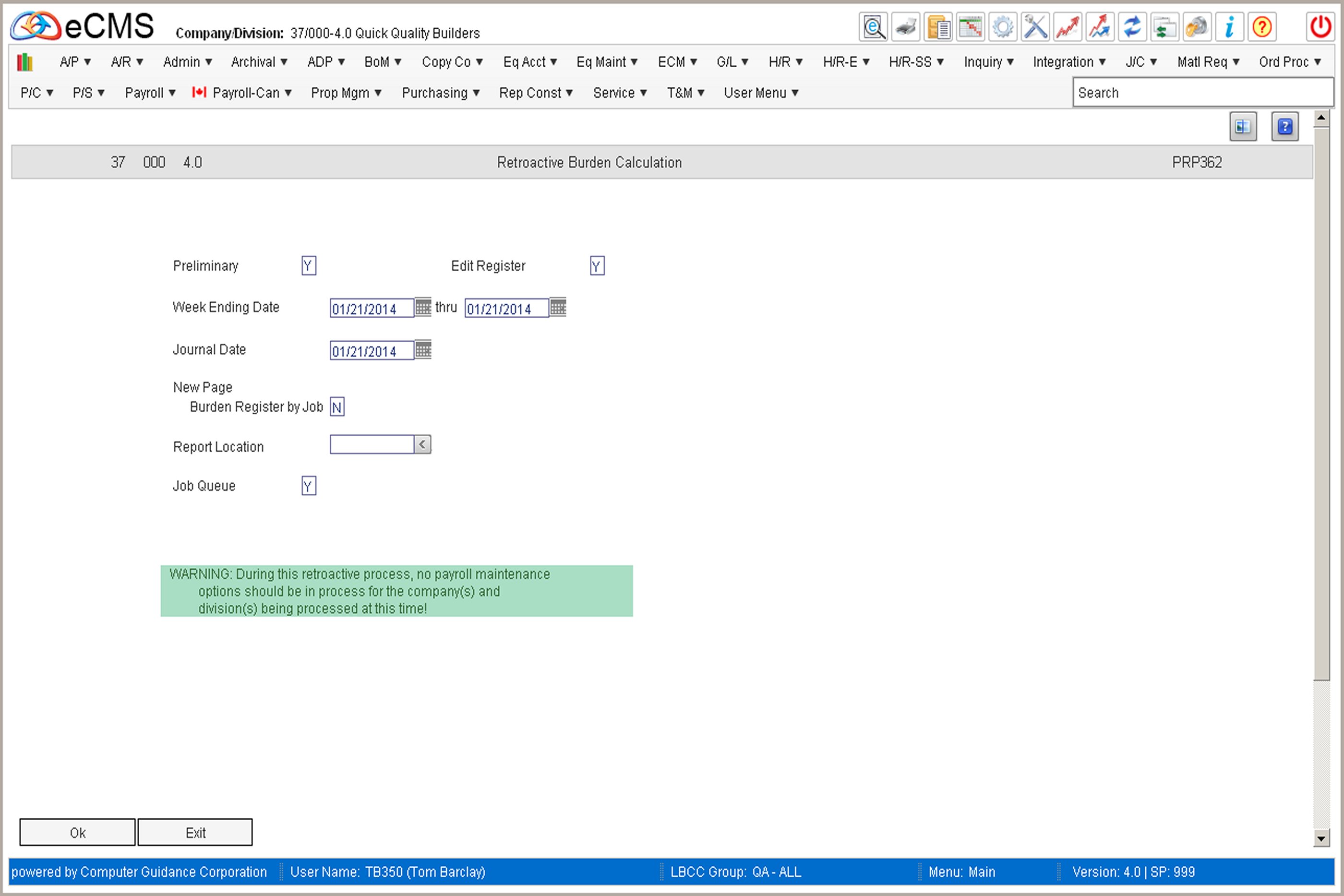

Retroactive Burden Processing Selection screen

Preliminary

Y |

Calculate all burdens and run a preliminary report without updating general ledger, job cost, worker compensation or union files. |

N |

Calculate all burdens and update general ledger, job cost, workers compensation and union files. |

Edit Register

Y |

Print an edit register of the transactions selected for retroactive burden processing. |

N |

Do not print an edit register of the transactions selected for retroactive burden processing. |

Week Ending Date

Enter the first and last week ending dates for the payroll transactions you want to be included in this Retro Burden Processing session. Records are selected by week ending date and not the processing journal date.

You can process one week at a time, multiple weeks, one month at a time, multiple months, all records at one time, etc. The period selected depends upon how you want the additional cost reflected in your general ledger and job cost records.

Journal Date

Enter the journal posting date you want to use to record the additional burden to general ledger and job cost. Union records will be posted by payroll week ending date.

New Page Burden Register by Job

Y |

Skip to a new page for each job on the Burden Register. |

N |

Do not skip to a new page for each job. |

Outq/Hold/Save

These fields will display only if the Archive Master record's Archive option is set to No and the Spool File Only option is selected.

Enter an Outq identifier to have this report sent to a specific output queue. Leave this field blank to send the report to the default output queue.

Enter Y in the Hold field to place this report on hold in the default, or specified, output queue.

Enter Y in the Save field to print the report, and then place it on hold in the default, or specified, output queue.

Report Location

Enter a report location, or leave this field blank to accept the default location. This field will display only if the Allow Over-Ride Output Location option is selected in your Group or User profile, and the Archive Master record's Spool File Only option is cleared.

Job Queue

Y |

Process the Burden calculation in the Job queue. |

N |

Process the Burden calculation interactively. |

Click to run the Retroactive Burden Processing procedure. The Register will be printed if the Edit Register option is set to Y. A Payroll Distribution Journal, and a Federal Tax Depository Summary will be printed in addition to the Edit Register.. |

|

Click to return to the Main Menu without saving changes. |

Note: During Retroactive Processing, no other Payroll Maintenance, or Processing, procedures should be running for the Companies/Divisions involved.

Delete Rate Files

This option is used to delete the burden rate files created during the Copy Rate Files procedure. This should only be done when all Retroactive Burden Processing has been completed.

Note: There are no selections associated with this procedure and it will run immediately upon being selected from the menu.

Click to delete the Retroactive Rate files.