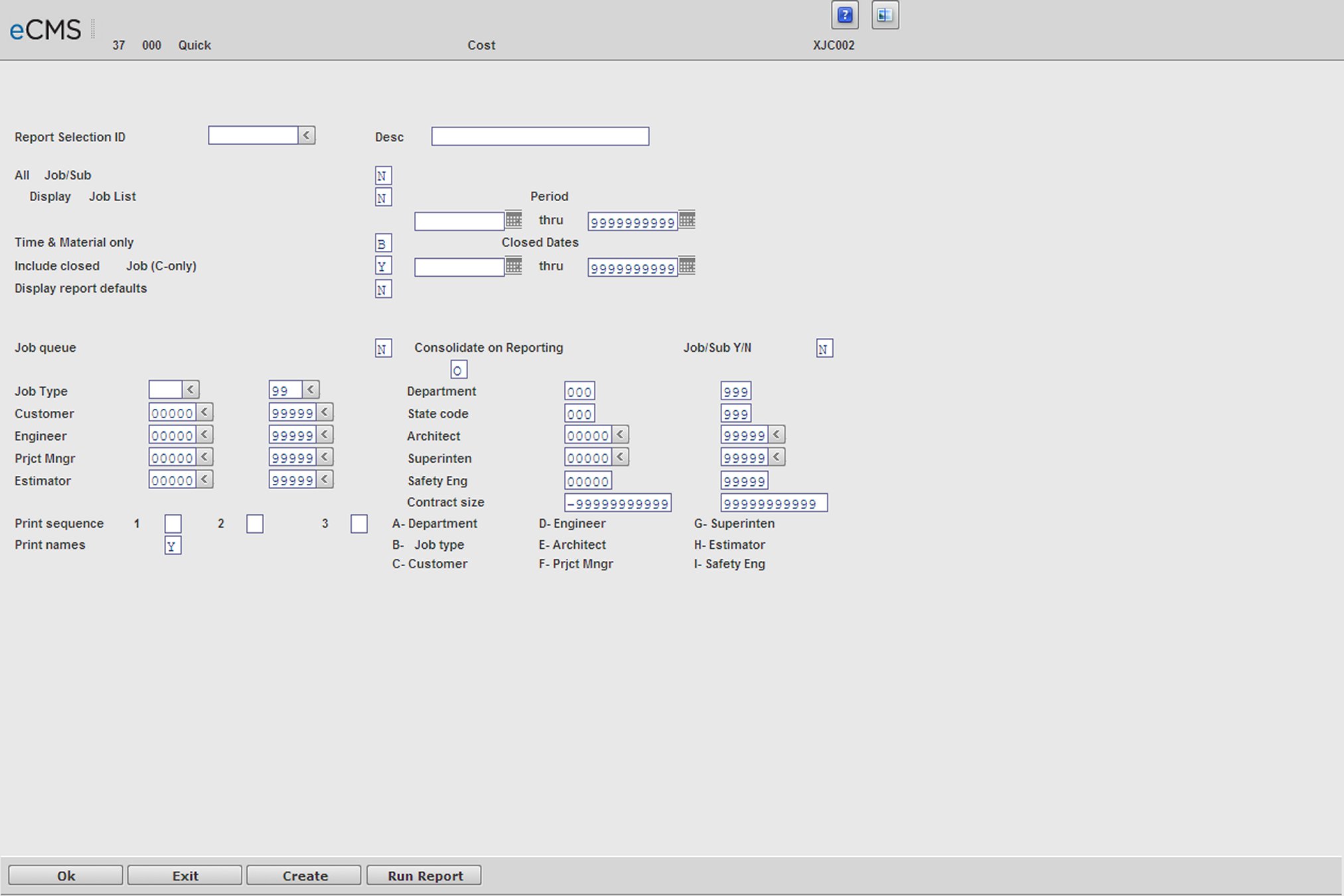

This overview explains the report selection options available for Financial Cost reports.

The report selection screen is used to select the types of Jobs to be reported and to determine which other screens will be displayed.

Report Selection ID

Click the prompt to select a Report Selection ID from a current list. To create a new Report Selection ID, enter that number and provide a description. When you have finished supplying the following field information, click the CREATE button.

All Job/Sub

Y |

All Jobs are included in the report. |

N |

Clicking OK or CREATE will open the Detail Job Selection screen on which to select the individual Job/Sub Jobs to include. |

R |

Clicking OK or CREATE will open the Range Job Selection screen on which to select a range of Job/Sub Jobs to include. |

Display Job List

Y |

Clicking OK or CREATE will open the Job List Selection screen. |

N |

Clicking OK or CREATE will open the Detail Job Selection screen. |

Time and Material Only

Y |

Include only Time and Material Jobs. |

N |

Include only Contract Jobs. |

B |

Include Both T&M and Contract Jobs. |

S |

Include only Service T&M and Service Contract Jobs. Jobs are coded Service Time & Material by setting their Time and Material field, in the Job Description file, to Service. |

Include Closed Jobs

Y |

Include both closed and open Jobs. |

N |

Include open Jobs only. |

C |

Include closed Jobs only. |

Date Range

Use the adjacent fields to define a range of dates for the Jobs to be included on the report.

Display Report Defaults

Y |

Clicking OK will open the Report Default Selection screen . |

N |

Use the current system default settings. |

Include Items with

This field displays only when the Job Cost default, Print Job Cost w/Activity Only, is set to Y. It does not display for all reports.

1 |

Any Activity |

2 |

Actual Costs |

3 |

Period Costs |

4 |

Actual Costs/Budget Costs or Committed Costs Only those records that have a non-zero amount in any of the following three columns: Actual Cost, Current Budget or Total Committed Cost, will be included on the Job Cost Actual Committed Report. If any records have zeros in all three columns, the report will not include those records when processed. |

Job Queue

Y |

Process the Job within the Job queue. |

N |

Process the Job before other Jobs within the Job queue. |

The following section of the Report Selection screen is used to further define the Jobs and sequence for printing. These fields are maintained in the Job Description file.

And (A)/Or (O)

A |

Jobs satisfying ALL the selection requirements will be included in the report. |

O |

Jobs satisfying ANY of the selection requirements will be included in the report. |

For the following criteria, enter ranges to be used when compiling this report.

|

|

|

|

|

|

|

|

|

|

|

|

Print Sequence

Enter up to three sort sequences for the report based on the following codes:

A |

Department |

E |

County Code |

B |

Job Type |

F |

Project Manager |

C |

Customer |

G |

Superintendent |

D |

Engineer |

H |

Estimator |

Print Names

Y |

Print the names of the project manager, superintendent, architect, etc., from the Job Description file. The names print in the heading area of the report. Use the Job Description Names option on the Job Cost File Maintenance Menu to enter descriptions for the Name Codes entered in the Job Description file. |

Click to open the Selection screens determined by these entries. |

|

Click to return to the Main Menu without processing entries. |

|

Click to save these entries under a new Report Selection ID. |

|

Click to run this report. |

The Detail Job Selection screen displays when the All Job/Sub and Display Job List fields are set to N. This screen is used to specify the individual Job/Sub Jobs to be processed. If an entry has been made on the eighth Job line, clicking OK will display additional Detail Job Selection screens.

Click to run the report or open another Selection screen based on the entries on the Report Selection screen. |

|

Click to return to the Main Menu without processing entries. |

|

Click to return to the Report Selection screen without processing entries. |

The Range Job Selection screen displays when the All Jobs/Sub Jobs field is set to R. This screen is used to enter the Job/Sub Job ranges to be reported. If an entry has been made in the final (8th) range, clicking OK will display an additional Range Job Selection screen.

Click to run the report based on these entries. |

|

Click to return to the Main Menu without processing entries. |

|

Click to return to the Report Selection screen without processing entries. |

The Job List Selection screen displays if the All Jobs/Sub field is set to N and Display Job List field is set to Y. This screen is used to place an X next to the Job/Sub Jobs to be reported. If more than thirty-six Jobs are on the system, click OK to continue on to the next Job List Selection screen.

Click to run the report based on these entries. |

|

Click to return to the Main Menu without processing entries. |

|

Click to return to the Report Selection screen without processing entries. |

Report Default Selection screen

The Report Defaults screen displays only if the Display Report Defaults field is set to Y.

Notes

All options are not available for all reports.

The T option (Job Totals) is not available for all reports.

Options are not necessarily displayed in the order shown below.

When the result of answering Y or N is obvious, only the less obvious result is explained.

Change Defaults

The Job Cost Report Defaults are displayed as applicable for each report. Change the defaults as required.

The changes entered here are "this time only" and will not permanently change the Job Cost Report Defaults.

Open Transactions only for closed Job Number(s)

This field will display only if the Include Closed field, on the calling Report Selection screen, is set to Y or C.

Y |

For closed Jobs, include only open transactions. Use this setting to include open dollar amounts on closed Jobs. |

N |

For closed Jobs, include all transactions. |

Print Cost Type Summary

Y |

A summary by Cost Type is printed at the end of each Sub Job and at the Company/Division level. Costs are summarized by the user defined codes in the Cost Type file. Common Cost Types are: |

L |

Labor |

E |

Equipment |

B |

Burden |

S |

Subcontract |

M |

Material |

O |

Overhead |

Use Summary Code In Cost Type file

Y |

Use the summary Cost Type set up in the Cost Type Master. This option allows the user to summarize groups of Cost Types when the reporting level of detail is not required on reports. Example: Labor might be reported as D (Direct) and I (Indirect). When this level of detail is not required on reports, direct and indirect labor can be summarized as L (Labor). See Summary Cost Type in Job Cost File Maintenance for details. |

All Cost Distribution

Y |

All Cost Distributions are included on the report. |

N |

Print the report for the Segment Number or range of Cost Distributions entered below. |

Segment

If the All Cost Distribution field is set to N, print the report for the Cost Distribution Segment entered in this field.

- or -

From/To

All alpha, all numeric or both alpha/numeric as defined in the Company Defaults.

Use the From/To fields to define a range of Cost Distributions to include on the report.

The following report defaults are available for the Job Cost Report Writer and the Summary Cost Type Report Writer.

All Cost Type(s)

Y |

Print the report for all Cost Types. |

N |

Print the report for the Cost Types entered below |

O |

Omit the Cost Types entered below from the report. |

Cost Type

If the All Cost Types field is set to I or O (see above), enter up to 5 Cost Type(s) to print, or omit.

Y |

Labor |

B |

Burden |

M |

Material |

N |

Equipment |

S |

Subcontract |

O |

Overhead |

Change Order Detail

Y |

Print the change order detail. |

Print Hours For All Cost Types

Y |

Print hours for all Cost Types which have hours. |

N |

Print only the Cost Type selected in the next field. |

Cost Type To Print

If the Print Hours For All Cost Types field is set to N, select the Cost Type to print.

Consolidate Sub Jobs

Used for the selection of the Summary Contract Analysis and Summary Job Analysis reports.

Y |

For each Job selected, combine the Sub Jobs. |

N |

Process Sub Jobs separately. |

T |

Print one summary (total) line per each Job/Sub Job number selected. |

Use Alternate Cost Distribution

Y |

Use the Alternate Cost Distribution set up in the Job Cost Master for reporting purposes. The percent complete is followed by an S indicating that the percentage is summarized using the weighted average method and to report to the client, in their pay item/cost code sequence, without altering the way you collect cost and manage your business. The Alternate Cost Distribution allows for one or many of your Cost Distributions to be accumulated into one alternate. |

Projected Cost Types

Specify which Cost Types are productivity based. Productivity based costs are usually Labor (L) and Equipment (E). Any Cost Type not specified as productivity based will be processed as a committed item. Material (M) and Subcontract (S) would normally be committed based costs. See the explanation of projected and committed methods of calculating Estimated Cost at Completion under the Report and Inquiry Heading Section later in this chapter.

Lowest Percentage Complete For Projection

Enter the lowest permissible percent complete for an activity before its Estimated Cost at Completion should be projected. If projected, the Actual Cost at Completion will be based on actual cost-to-date and percentage complete.

Enter 00 to calculate for all activities.

Include Unprocessed Payroll

Y |

Include entered but unprocessed (not selected for payroll processing functions) payroll transactions in the report. |

Include Unprocessed Equipment

Y |

Include unprocessed equipment usage records in the equipment work file on Job Cost reports. Unprocessed records will not update the Job cost file until the equipment update procedure has been run. This feature only adjusts the Job reports with unprocessed equipment. |

Use Reported Estimate At Completion

Y |

Use your reported Estimated Cost at Completion instead of allowing the system to calculate the cost at completion. The system will calculate the Estimated Cost at Completion if it has not been reported. |

N |

The system will calculate the Estimated Cost at Completion. |

Use As Bid Budget

Y |

The “Use As Bid Budget,” from the Job Cost Master, will be used in place of the current (revised) budget and no variable budget logic will be used. If the 100% Complete field, in the Job Description, is set to Budget, the original budget and change orders will be used for the Estimated Cost at Completion. “Use As Bid Budget” will display on the printed selection page for the reports affected. |

Include On Order Amount in Committed Cost

Many of the Job Cost Reports can reflect On Order Inventory from the Order Processing application, for both Job and customer/Job orders, as committed costs on the cost reports. (Included in the Purchase Order committed amount.)

If you enter a Y, “On Order” inventory amounts will be reflected as committed cost and will be used in the report projections on the following:

|

|

|

|

|

|

|

|

|

|

It will display in the Create Job Dictionary and Job Cost by Summary Cost Type, if committed cost is selected. It can be overridden on each report selection for all reports except the Projected Final Cost Report.

Jobs Over Budget

Y |

Include only Jobs which are over budget on the report. |

Job With Loss

Y |

Include only Jobs with an estimated loss at completion. |

Process As If Closed

Y |

All cost codes are processed as 100 percent complete, using actual cost as the Estimated Cost at Completion to derive the variance. |

N |

The calculated Estimated Cost at Completion is used to derive the variance. |

Payroll at Actual Pay

Y |

Print the Actual Pay on the report. |

N |

Print the Standard Pay charged to the Job. |

Report Total Committed

(This option is used only on the Actual/Committed Cost Report.)

Y |

Report total committed costs (open commitments plus actual cost) instead of only open commitments in the committed cost column. If this option is selected Estimated Cost at Completion for a "committed activity" (not projected) is the greater of current budget or total committed. |

N |

Report open balance of commitments on the Actual/Committed Cost Report. |

Double Space

This option is only used on the Actual/Committed Cost Report.

Y |

Skip an extra space between lines on the report. |

N |

Do not skip extra spaces on the report. |

Print Selection Options

Y |

Print a cover page at the beginning of the report showing the report options selected. |

Number Of Copies

Enter the number of copies desired.

Forms Type

Enter the desired forms type, or accept the default *STD.

Outq/Hold/Save

Enter an Outq identifier to have this report sent to a specific output queue. Leave this field blank to send the report to the default output queue.

Enter Y in the Hold field to place this report on hold in the default, or specified, output queue.

Enter Y in the Save field to print the report, and then place it on hold in the default, or specified, output queue.

Click to run the report based on these selections. |

|

Click to return to the Main Menu without processing entries. |

|

Click to return to the Report Selection screen without processing entries. |

Report and Inquiry Headings

The following is a glossary of the fields used on the eCMS Job Cost reports and inquiries.

Original Budget

The original budget (estimate) is the amount entered in the Job cost file budget field. This amount should be adjusted by entering change orders.

Current Budget

The Current Budget (estimate) for a Cost Distribution is the original budget plus or minus any change orders. If a budget has been adjusted by a change order an R is printed next to the budget amount if it has a positive balance, an N is printed next to the budget if it has been adjusted to a negative balance.

Actual Costs

Actual costs are costs that have been entered into the Job Cost System through the Accounts Payable, Payroll, Inventory and Equipment Costing Systems or by Journal Entries. Optionally, received/unapproved P/O amounts could be reflected as actual.

Committed Costs

Committed Costs are comprised of open purchase order quantities or amounts and Subcontract unbilled balances. On the Actual/Committed Report Total Committed (actual cost plus open commitments) can be optionally shown.

Purchase order items received but not entered into accounts payable (called Received/Unapproved in eCMS) are included in the committed cost amount, or added to actual cost depending on option selected in the Job Cost default values. They are shown in a separate column on the Actual/Unapproved Project Cost Report to allow a highlight of items that could be included on billings.

Open-to-Buy/Cost or Cost Remaining

Open-to-buy or cost remaining is calculated as follows:

The committed method uses the current budget as the Estimated Cost at Completion. The open-to-buy is calculated by Subtracting the sum of the actual costs-to-date and open commitments (and received/unapproved) from the Estimated Cost at Completion. If the sum of the actual costs-to-date plus open commitments exceeds the Estimated Cost at Completion, that becomes the Estimated Cost at Completion and there is a cost variance no open-to-buy is shown. If the sum of the actual costs-to-date plus open commitments is less than the Estimated Cost at Completion, the difference is shown as open-to-buy.

For projected items the cost remaining is calculated by Subtracting the actual cost plus open commitments (and received/unapproved) from the Estimated Cost at Completion. See explanation of how the Estimated Cost at Completion is calculated. If the sum of the actual costs-to-date plus open commitments exceeds the Estimated Cost at Completion no open-to-buy is shown. If the sum of the actual costs-to-date plus open commitments is less than the Estimated Cost at Completion, the difference is shown as open-to-buy.

Est Cost At Completion

The Estimated Cost at Completion is calculated by either the projected or committed methods unless the user enters their estimate of cost at completion and selects the option to use that value on a report or inquiry.

Projected Method

Reports and inquiries project the cost at completion for user selected projected Cost Types by extrapolating actual costs plus open commitments against the percentage complete. The percentage complete is reported by the user or calculated by the system in the following sequence: actual quantity to estimated quantity, actual labor hours to estimated labor hours or actual dollars to estimated dollars. Behind the percent complete field on the cost reports is a code which shows how the percent of completion is calculated.

I |

Revised by Change Order |

R |

Estimated percent complete entered through field reporting |

Q |

Quantities entered through field reporting |

H |

Hours entered through payroll |

D |

Total dollars collected in Job cost |

S |

Percent complete is based on alternate pay item/cost code |

Note: When selecting Cost Types to be projected, remember that open commitments and received/unapproved items are added to the actual costs in the projection calculation.

Committed Method

Reports and inquiries calculate the Estimated Cost at Completion as the sum of the actual costs-to-date and the balance of open commitments or the budget, whichever is greater.

Variance (Over */Under)

The budget variance is calculated by Subtracting the Estimated Cost at Completion from the current budgeted cost. Only negative variance (over budget) conditions are reported for committed items until they are reported as 100% complete. Under budget amounts are shown as cost remaining for committed items.

In both detail and summary reports, variances are calculated budget line item by budget line item. Cost remaining for one line item is not netted against an over budget (negative variance) condition of another line item.

To obtain proper variances and estimated costs at completion, budgets must be entered and maintained with change orders and costs must be entered against the proper Cost Distribution. If costs are not applied to the correct budget line items the following condition will occur:

|

Budget |

Actual |

Cost Remaining |

Estimated Cost at Completion |

Variance |

Item 1 |

1000 |

0 |

1000 |

1000 |

0 |

Item 2 |

0 |

1000 |

0 |

1000 |

1000 |

Job Total |

1000 |

1000 |

1000 |

2000 |

1000 |

Even though the actual cost is equal to the budget the incorrect application of cost information has caused the reporting of an incorrect Estimated Cost at Completion and incorrect variance.