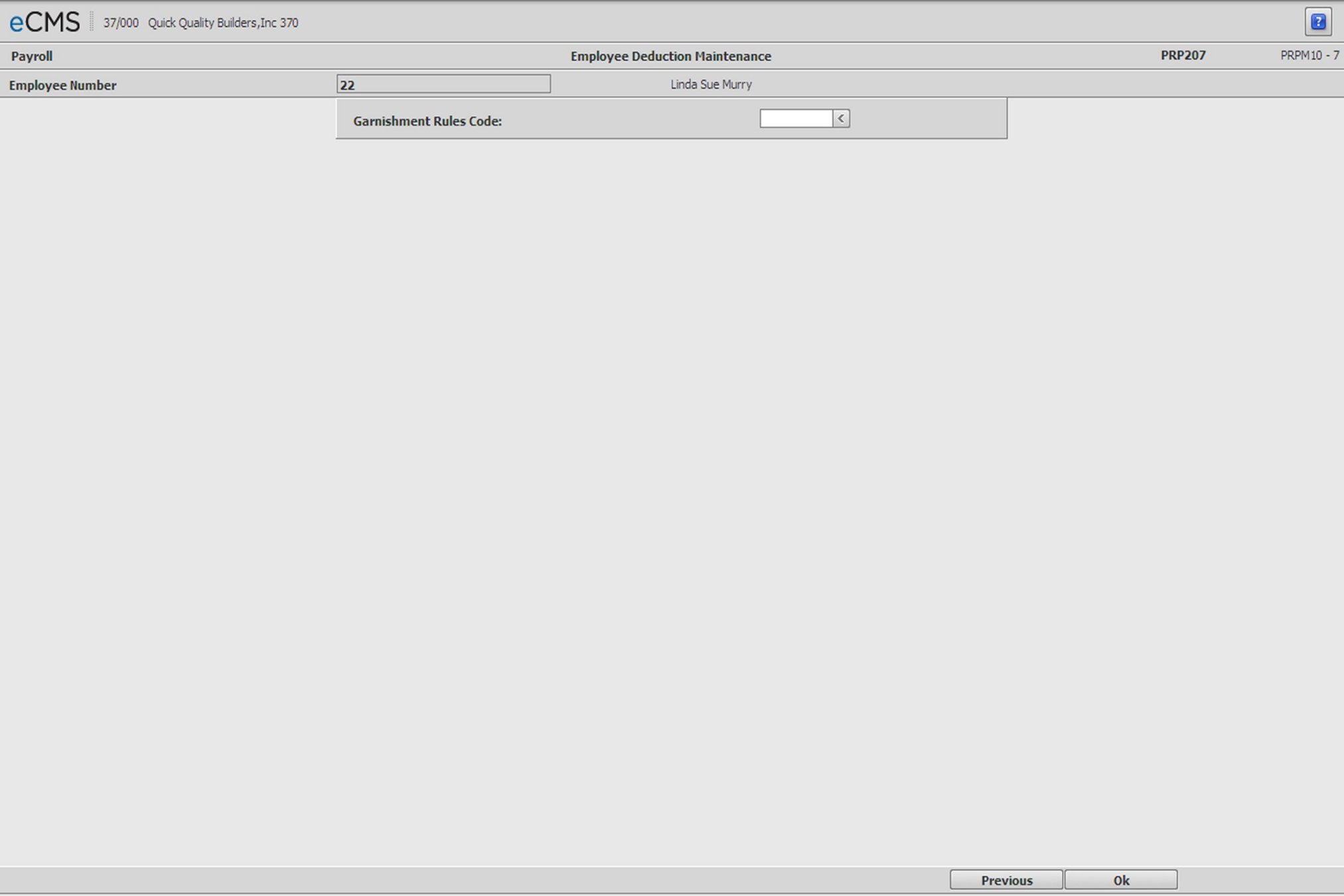

Employee Deductions - Garnishment Rules

This screen displays when an M Deduction record was selected that:

Has the Garnishment option selected.

Does not have a Garnishment Rules code created.

Garnishment Rules Code screen 1

Garnishment Rules Code

Enter an identifier for this Garnishment Rule. An entry in this field is required.

Click to save changes and display screen 2 below. |

|

Click to return to the Employee Deduction Selection screen without saving changes. |

Garnishment Rules Code screen 2

The following screen will display for all deductions that have the Garnishment option selected on the M record. The fields represent limits for all the garnishment details attached to the deduction record, and their values will default to the corresponding entries made on that record.

Description

Enter a description for this Garnishment code. An entry in this field is required.

Basic Exclusions

Condition of Employment Deduction

These are deductions imposed by an employer as a condition of employment. An example might be Union dues, if membership in a Union was mandatory.

Select this option if deductions are imposed that constitute conditions of employment.

Health Insurance Deduction

Select this option if deductions are taken for the purpose of Health Insurance.

Other 1/Other 2

Select these options if deductions are imposed that should not be subject to the basis upon which a garnishment should be applied.

Allocation Method

This entry will indicate how to divide the deduction if there is not enough to satisfy all garnishments, and only applies to garnishments attached to this record. A selection from the drop-down prompt is required.

Pro-Rated |

Each garnishment will receive a portion of the total, based on its percentage of the total of all garnishments. |

Order Received |

A garnishment will be fully satisfied in the order in which it was received before the next garnishment is addressed. |

Even Split |

All garnishments will receive an equal amount. |

Calculation Limits

Fixed Amount

For a deduction of a specific amount per pay period, enter that amount here.

- or -

Percent

For a deduction based upon a percentage of the employee's gross or net pay, enter the percentage in this field and the appropriate code (described below) in the Percentage Code field.

Code

For a deduction based upon a percent of the employee's pay, click the prompt and select a percentage code to indicate whether the percentage applies to gross or net pay.

None |

This option is valid only if the Percent field is zero. |

Gross |

Deduction is a percentage of Gross Pay (Reg + Overtime + Other + Adj x %) |

Net |

Deduction is a percentage of Net Pay (Reg + Overtime + Other + Adj - Taxes x %). Net Pay deductions are defined by the Basic Exclusions described above. |

Remaining Amount

This is the amount of net pay that must remain after the garnishments attached to this record have been applied. Any deductions that follow will be taken from this amount.

Remaining Amount Code

Click the drop-down prompt and select one of the following from the list.

None |

This selection is only valid if the Remaining Amount field is zero. |

Amount |

The remaining amount indicated above will be used. |

Percent of Net |

The remaining amount indicated above will be used as a percent of the Net. Net Pay deductions are defined by the Basis Exclusions described above. |

Calculation Code

This selection determines if the greater of the Fixed Amount or Percent entries will be used, or the lesser.

None |

This selection is only valid if the Percent field is zero. |

Lesser Amount |

The lesser of the Fixed Amount or Percent entries will be used. |

Greater Amount |

The greater of the Fixed Amount or Percent entries will be used |

Frequency Code

A Deduction Frequency code determines at what point a deduction will be taken from the employee's paycheck, or a benefit will accrue for payment. The Week Number used in payroll entry (see Entry ) and the Frequency code entered here are compared to determine if the deduction, or benefit, should be taken or accrued during each pay period. Deductions with a Frequency code of Monthly must be cleared by running the option on the Monthly Processing Menu at the end of each period. This will allow the deduction to be taken the next period.

Click the prompt and select a Frequency code from the drop-down list.

|

|

The master record for a new employee must be entered during a period prior to running the Clear Union Deduction Code option in order for this Benefit/Deduction to calculate in the next months processing. If an employee is entered during a period after the Clear Union Deduction Code option has been run, this benefit/deduction will be processed for that employee the next time the file is cleared.

Print on Stub

Select this option to have the deduction print on the check stub. This will apply to all deduction records.

Related Deductions

This section lists all the deduction records linked to this rule record. Select a record and click OK to view it in detail in the Garnishment Detail screen.

Click to view, or modify, detail associated with this Garnishment record. |

|

Click to return to the Main Menu without saving changes. |

|

Click to return to the Employee Deduction Selection screen without saving changes. |

Garnishments Rules Code screen 3

Description

Enter a description for this Garnishment code. An entry in this field is required.

Garnishment Rule

This deduction can be re-assigned only to a different rules code for the same employee. This entry must be a currently set up Garnishment rule. For information on creating a new Garnishment Rule Garnishments Rules Code screen 1.

Date/Time Received

Enter the Date the Garnishment was first received, or click the icon to select from a calendar. A Date Received is required, however the Time Received is optional.

Expiration Date

If the check date is equal to or greater than this date, the system will stop taking the deduction. Enter an expiration date, or click the prompt to select from a list. This entry is optional.

Garnishment Amount

Enter the total amount of the garnishment. This amount will be compared to the Amount Taken to Date below to determine if the garnishment has bee paid off. If this amount is left blank, then there will be no limit to the garnishment.

Fixed Amount

For a deduction of a specific amount per pay period, enter the amount in this field.

- or -

Percent

For a deduction based upon a percentage of the employee's gross or net pay, enter the percentage in this field and the appropriate code (described below) in the Percentage Code field.

Code

For a deduction based upon a percent of the employee's pay, click the prompt and select a percentage code to indicate whether the percentage applies to gross or net pay.

None |

This option is valid only if the Percent field is zero. |

Gross |

Deduction is a percentage of Gross Pay (Reg + Overtime + Other + Adj x %) |

Net |

Deduction is a percentage of Net Pay (Reg + Overtime + Other + Adj - Taxes x %) |

Amount Taken to Date

This field is posted with the amount of the deduction taken. It is the sum of all deductions for this garnishment from the beginning. When this amount matches the Garnishment Amount (see above) the deduction will stop automatically unless arrearage exists.

Arrears Amount

Enter the amount of deductions in arrears. This is never posted automatically. The arrearage entered in this field is that provided by the court. Arrearage is satisfied only after all current amounts for all garnishments are satisfied. Both a current amount and an arrears amount may be taken on the same paycheck.

Arrears Taken to Date

This field is posted with the amount of the arrearage deduction taken. It is the sum of all arrearage deductions for this garnishment from the beginning. When this amount matches the Arrears Amount (see above) the deduction will stop automatically.

Fee to Court

Enter the amount of administrative fees to be paid to the court. These fees are charged in addition to the Garnishment Amount. The garnishment and fee amount added together may not exceed the maximums imposed by the Limit Amount field on the Employee Deduction Detail screen.

Fee to Employer

Enter the amount of administrative fees to charged internally for processing the garnishment. These fees are assessed in addition to the Garnishment Amount. The garnishment and fee amount added together may not exceed the maximums imposed by the Limit Amount field on the Employee Deduction Detail screen.

Employer Fee Account

This is the General Ledger account to be credited with the amount of the Employer fee.

Vendor Number

Enter a valid Vendor Number, or click the prompt to select from a list.

Distribution Company/Division Number

Accept the Company/Division used at login or, if the Vendor Master record is in a different Company/Division, click the Division Number prompt to make new selections from a list. The Company/Division Numbers are used for Inter-company transactions at the detail level.

The Vendor and Company/Division entries will allow a deduction, or benefit, to automatically build an open Accounts Payable transaction.

The following processing occurs during Payroll Update:

1. These transactions will update the Accounts Payable batch file with a batch number of 88888.

2. The Liability Account will be used to post the tax liability during Payroll Update. When the batch entries are updated in Accounts Payable, a debit entry will be posted to this account and a credit entry will be posted to the Accounts Payable control account.

3. All of the transactions will be summarized according to Vendor Number/G/L Account Numbers to create one invoice per Vendor.

The invoices will be created during Payroll Update if the Vendor Number is currently set up and is non-zero. The Vendor Number cannot be added to the Vendor Master during this procedure.

Invoice Description

Enter a description of this invoice to be printed on the check stub during the next check run.

Notes

Enter any additional information regarding this invoice that should be printed on the check stub during the next check run.

Processing Company/Division

The CO/DIV that is affected by the deduction.

Case Identifier

Enter the identifier assigned to the case by the enforcement entity when the case was established.

Medical Coverage

Blank |

This option is valid only if the Case Identifier field is not entered. |

Yes |

This employee has Medical Coverage. |

No |

This employee does not have Medical Coverage. |

FIPS Code

Enter the Federal Information Process Standard (FIPS) code. The FIPS code refers to the assigned code of the enforcement entity receiving the garnished payments.

Click to process these entries and return to the Garnishments Rules Code screen 1. |

|

Click to return to the Main Menu without saving changes. |

|

Click to delete the current record. |

|

Click to return to the Garnishments Rules Code screen 1 without saving changes. |