Use this menu option to update QTD/YTD payroll data for an employee. If your company is converting to the CGC Payroll System in the middle of a calendar year, you must use this selection to maintain employee earnings and tax information.

Control totals need to be established before beginning data entry; run the 941A reports to check the accuracy of data entered.

A Security Code with executive payroll security functions is required to maintain the records of executive employee’s classified as such in the Employee Master file.

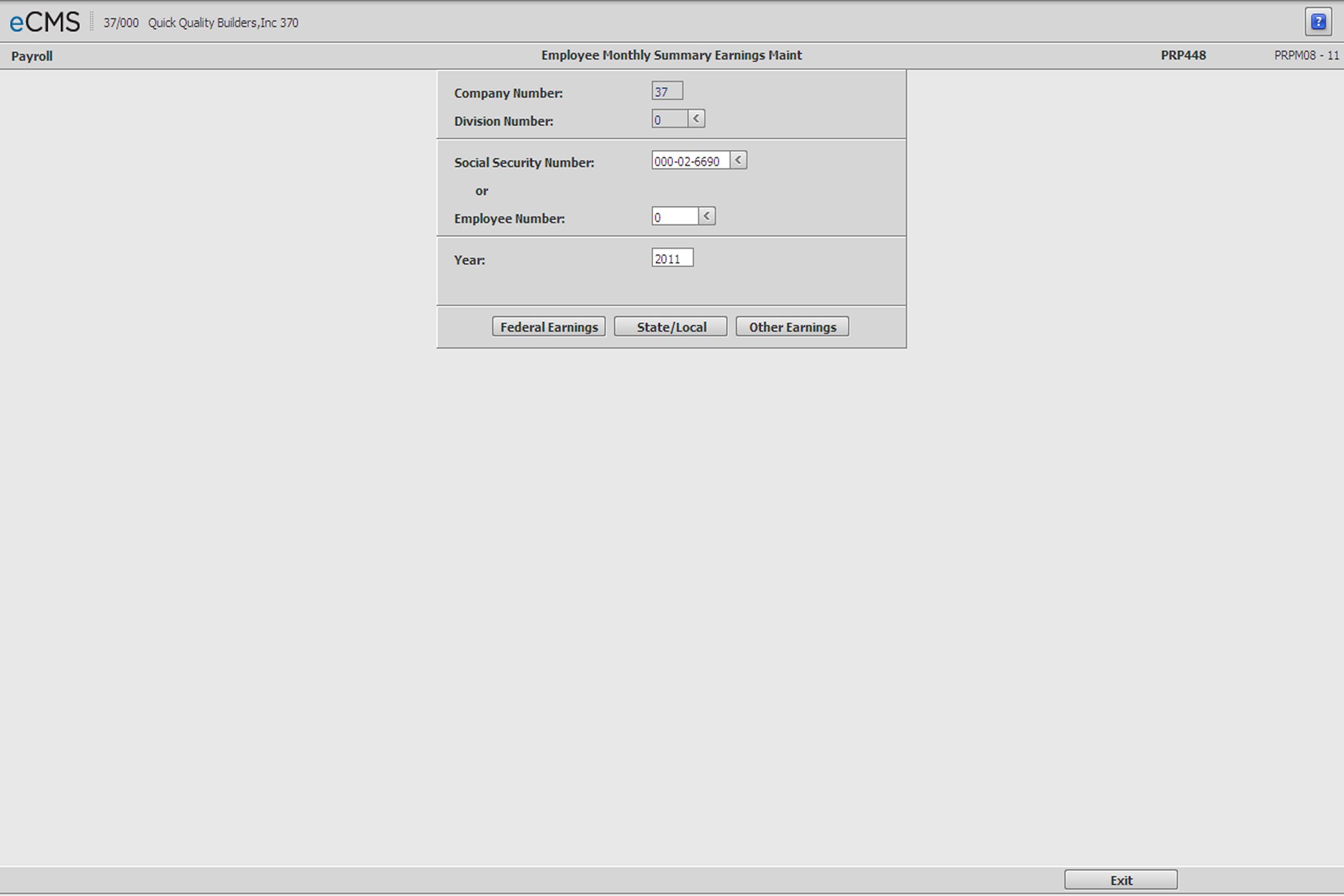

Click Employee Qtd/Ytd Earnings from the Payroll File Maintenance menu to display the screen below.

Employee QTD/YTD Earnings Selection screen

Company/Division Number

Accept the Company/Division used at login, or click the Division Number prompt to make new selections from a list.

Social Security Number

Enter an Employee’s Social Security Number, or click the prompt to select from a list.

- or -

Employee Number

Enter an Employee Number, or click the prompt to select from a list. Employee Numbers can be duplicated across Companies and Divisions (and must be when consolidating W2's).

Year

Enter the calendar year for which the earnings are being maintained.

Click to access the Federal QTD/YTD Earnings Selection screen. |

|

Click to access the State/Local QTD/YTD Selection screen. |

|

Click to access the Other QTD/YTD Selection screen. |

Click to discard changes and return to the File Maintenance menu. If the employee has an active record in the Employee Master, one of the following screens displays: |

Federal QTD/YYD Earnings Selection screen

This screen displays when the Employee has an active record in the Employee Master and you click OK on the Employee QTD/YTD Earnings Selection screen displayed above.

Use the Page Up/Page Down arrows ![]() to access additional fields.

to access additional fields.

Enter the following data at the time of conversion to eCMS. To produce quarterly reports, enter this information by quarters using the last month of each quarter.

FIT EIC FICA (SS) FICA (MC) Prior FICA Gross Earnings Gross Taxable Prior Taxable Sick Pay Exempt with T FICA Exempt Weeks Worked Hours Worked Vacation Hours Sick Hours FICA (ER) Holiday Hours SUTA |

Fed Income Tax Earned Income Credit FICA (Social Security) FICA (Medicare) Prior FICA Withholdings * Gross Earnings Gross Taxable (include income Exempt from FIT **) Prior Taxable Earnings Sick Pay Ded from Gross Txbl for W2 (401K & S125) Ded from Gross Txbl for W2 (S125) Weeks Worked Total Hours Worked Total Vacation Hours Taken Total Sick Hours Taken FICA (Employer) Total Holiday Hours Taken Total SUTA Covered Earnings |

Note: Data fields for tips only display when the Employee Master indicates that an employee receives tip income. Please consult your accountant or the Internal Revenue Service before using the following fields. |

|

Tips Reported Tips Generated Tips Deemed Wages Tips In Excess |

Tips reported by employees Tips calc to equal min wage (Min Wage - hourly rate - tips reported) Tips calc to equal min wage (Min Wage - hourly rate) Tips rep in excess of min wage |

* When transferring employees from one company to another, the prior FICA taxes withheld are entered here to prevent over taxation.

** Earnings that are exempt from federal income tax such as 401K and S125.

Hours

Enter the hours worked by an employee in each of these categories:

Hours |

[9N, 2D] |

Total of all hours for hourly employees |

Vacation |

[9N, 2D] |

Vacation Hours Taken |

Sick |

[9N, 2D] |

Sick Pay Hours Taken |

Holiday |

[9N, 2D] |

Holiday Pay Hours Taken |

SUTA Covered Earnings

Enter the total YTD earnings that are subject to SUTA tax in all states worked this year by this employee.

Example: An employee who worked in three states with the following earnings:

State |

Earnings |

Limit |

Covered Earnings* |

Arizona |

5,500.00 |

7,000 |

5,500.00 |

Texas |

2,000.00 |

7,000 |

1,500.00 |

New Mexico |

5,000.00 |

9,600 |

2,600.00 |

Total SUTA Earnings |

|

|

9,600.00 |

If this employee worked in New Mexico first, the total SUTA earnings would be 7,000, as follows:

State |

Earnings |

Limit |

Covered Earnings* |

New Mexico |

5,000.00 |

9,600 |

5,000.00 |

Arizona |

5,500.00 |

7,000 |

2,000.00 |

Texas |

2,000.00 |

7,000 |

00 |

Total SUTA Earnings |

|

|

7,000.00 |

* Up to the limits established in your SUTA tax tables.

Click to process these entries and return to the Employee QDT/YTD Earnings Selection screen. |

|

Click to return to the Main Menu without saving changes. |

|

Click to return to the Employee QDT/YTD Earnings Selection screen without saving changes. |

Note: If you are converting to eCMS in the middle of a calendar year, use this option to add or update QTD/YTD earnings and tax information in the Employee State and Local file.

State/Local QTD/YTD Earnings Selection screen

Note: It is important to establish control totals from the old system before entering data. Run the 941A Register from the eCMS Payroll System, and then the equivalent from the previous system to balance the controls before proceeding

Company/Division Number

Accept the Company/Division used at login, or click the Division Number prompt to make new selections from a list.

Social Security Number

Enter the Employee’s Social Security Number, or click the prompt to select from a list.

- or -

Employee Number

Enter the Employee Number, or click the prompt to select from a list. Employee Numbers can be duplicated across Companies and Divisions (and must be when consolidating W2's).

Click the Type Code prompt and select the type of record being maintained.

|

|

|

|

|

|

|

|

|

Enter the number of the State or Local taxing entity, or click the prompt to select from a list.

Click to process these entries and display the State/Local QTD/YTD Earnings Detail screen. |

|

Click to return to the Main Menu without saving changes. |

|

Click to return to the Employee QDT/YTD Earnings Selection screen without saving changes. |

State/Local QDT/YTD Earnings Detail screen

Use the Page Up/Page Down arrows ![]() to access additional fields.

to access additional fields.

Enter the following State or Local earnings and tax information. To produce quarterly reports, enter this information by quarters using the last month of each quarter.

Gross Taxable Tax Amount Exempt with T Hours Worked Weeks Worked |

Gross Taxable (include income Exempt with T) Total State or Local Tax Withheld Ded from Gross Taxable for W2 Total hours worked Weeks worked |

Note: Data fields for tips only display when the Employee Master indicates that an employee receives tip income. Consult your accountant or the Internal Revenue Service before using the following fields. Data fields for tips are not displayed for the SDI/Local and SUTA Screens. |

|

Tips Reported Tips Generated Tips Deemed Wages Tips In Excess Tips Allocated |

Tips reported by employees Tips calculated to equal min wage (Min Wage / hourly rate / tips reported) Tips calculated to equal min wage (Min Wage / hourly rate) Tips reported in excess of min wage Tips allocated to meet min wage |

Click to process these entries and return to the State/Local QTD/YTD Earnings Selection screen. |

|

Click to return to the Main Menu without saving changes. |

|

Click to return to the State/Local QTD/YTD Earnings Selection screen without saving changes. |

Other QTD/YTD Earnings Earnings Selection screen

This screen is accessed from the OTHER EARNINGS tab on the Employee QTD/YTD Earnings Selection screen.

Note: If converting to eCMS in the middle of a calendar year, use this option to enter data for QTD/YTD Miscellaneous Earnings, Benefits, Deductions and Adjustments.

It is important to establish control totals from the previous system before entering data.

Company/Division Number

Accept the Company/Division used at login, or click the Division Number prompt to make new selections from a list.

Social Security Number

Enter the Employee’s Social Security Number, or click the prompt to select from a list.

- or -

Employee Number

Enter the Employee Number, or click the prompt to select from a list. Employee Numbers can be duplicated across Companies and Divisions (and must be when consolidating W2's).

Type Code

Click the Type Code prompt and select the type of record being maintained.

|

|

|

Distribution Number

Enter the number assigned to this Benefit/Deduction in the Payroll Distribution Master, or click the Deduction Type prompt to make these selections from a list.

Deduction Type

Enter the Deduction Type code assigned to this Deduction in the Payroll Distribution Master, or click the prompt to select from a list.

Click to process these entries and display the Other QTD/YTD Earnings Detail screen. |

|

Click to return to the Main Menu without saving changes. |

|

Click to return to the Employee QTD/YTD Earnings Selection screen without saving changes. |

Other QTD/YTD Earnings Detail screen

Enter the following earnings and tax information. To produce quarterly reports, enter this information by quarters using the last month of each quarter.

Amount

Enter the Benefit/Deduction amount for each period.

Click to process these entries and return to the Other QTD/YTD Earnings Selection screen. |

|

Click to return to the Main Menu without saving changes. |

|

Click to return to the Other QTD/YTD Earnings Selection screen without saving changes. |

Payroll Earnings

Report and Query users:

The Earnings file (PRPERN) reflects the record code (ERCCD) which indicates the type of earnings.

The sequence number tells the system the detail behind the type and each sequence indicates a different type of detail

ERRCCD |

ERSQ02 |

A. Adjustments B. HRP Benefits C. Employee SUTA D. Deduction P/R E. Deduction H/R F. Federal L. Local N. Union O. Oregon Local Tax Q. Québec S. State T. SDI/Local U. SUTA V. Employee W/C Deduction Z. W2 Box |

01 Gross Taxable 02 Tax Withheld 03 Exempt With H Tax 04 SUTA Covered Earnings 08 W/C Exempt 10 Gross Earnings 11 FICA Tax with H (SS) 12 FICA Tax with H (Medicare) 13 FICA Exempt 14 Sick Pay 15 Prior Taxable Earnings (First Bucket) 16 Prior FICA Tax-SS (First Bucket) 17 Prior FICA Tax-Medicare (First Bucket) 20 Tips Reported 21 Tips Generated 22 Tips Deemed Wages 23 Tips in Excess 24 Tips Allocated (First Bucket) 30 Hours Worked 31 Vacation Hours 32 Sick Hours 33 Holiday Hours 34 Safe Hours Worked 40 Weeks Worked |