This menu option allows you to add, delete or update records in the Employer Bank Account Master file. It also makes it possible to print payroll checks for specific job sites by associating Job Numbers with a Payroll Bank Account.

A record must be set up for each Cash Account used. The Employer Bank Account Master file maintains a record for each employer bank account.

The Employer Bank Account Master is also used by the Payroll System for maintaining the last check number used for each bank account and for direct deposit of employee payroll.

If the Payroll System is set to number checks by Company (Payroll Default Check Number is set to C), the Payroll check writing function displays the next check number to be used for each bank account in the check run.

If the Payroll System is set to number checks System-wide (Payroll Default Check Number is set to S), a record is written to the Employer Bank Account file with a Company/Division number of 99-999, and a General Ledger account number of all 9's, each time a check is written. The subsequent check number is then pulled from that file.

Note: Multiple Cash Accounts are not accommodated.

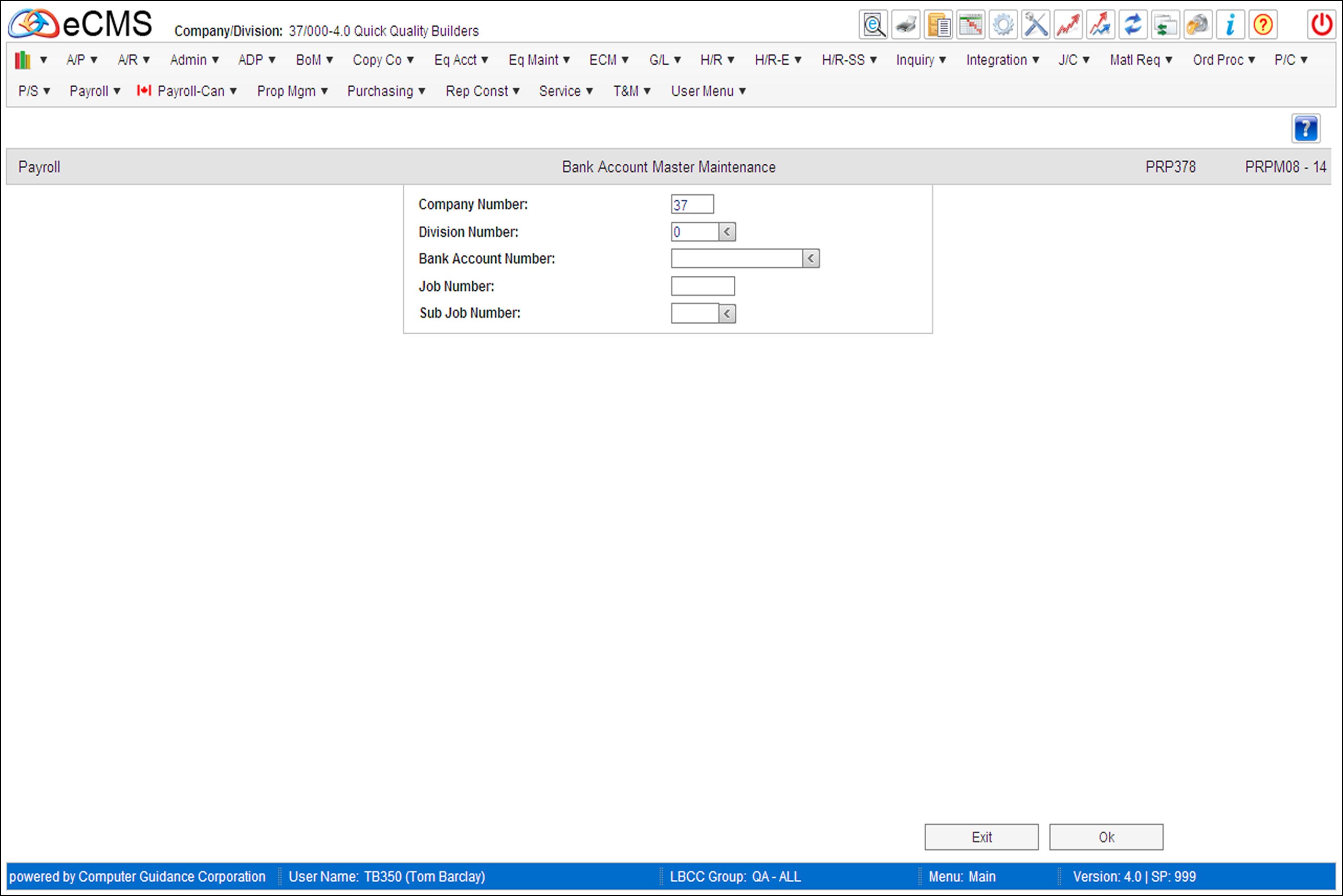

Employer Bank Account Master Selection screen

Company/Division Number

Accept the Company/Division used at login, or click the Division Number prompt to make new selections from a list.

Bank Account Number

Enter the Bank ID Number, or click the prompt and selecting from the list. This is the encoded number at the bottom left corner of checks and deposit slips which precedes the check and account numbers.

Note: You will receive a warning if your Bank Account Number is not National Automated Clearing House Association (NACHA) compliant. You can click OK to accept the change. Please check with your bank for current NACHA standards.

Job/Sub Job Number

Enter a job number only if you want to process payroll checks by job. You may create as many job number records for the same G/L account number as desired. Prior to associating a Payroll Bank Account with a Job/Sub Job, you must set up an instance of that account (an account that is not associated with any Job/Sub Job.

Click to process these entries and display the Employer Bank Account Master General screen. |

|

Click to return to the Main Menu without saving changes. |

Employer Bank Account Master General screen

Description

Enter the description for the bank. This description is used on Payroll reports.

Next Check Number

The Check Number that auto-fills in this field is determined by check records in the Bank Account Master file for this account. Accept this number, or override it by entering a new check number.

Positive Pay

This option was initiated as a modification for Positive Pay. Additional POS PAY instructions are in this guide.

When this option is selected, records will be created in the Positive Pay work files in a format specified by the bank.

Note: This option works only for customers who have the free modification for this process installed. Leave this option cleared tf the custom modification for positive pay has not been installed.

Company Name to Print on Checks

When selected, this option overrides the Payroll default, Print on Checks: Company Name, and the Company Name and Address entered on this screen will print on payroll checks printed during payroll processing and blank check runs.

If this option is cleared, the Print on Checks: Company Name default setting is used to determine if the Company Name and Address is used printed during payroll check runs.

Origin Bank ID

The Originating Depository Financial Institution is the bank receiving the magnetic media for processing. To be valid, a record for this bank must be entered in the Bank ID Master.

Enter the Bank ID for the originating bank, or click the prompt to select from a list.

If this number is your Federal identification number, do not enter dashes.

If you have multiple companies, this number should be the Federal identification number of the primary bank.

Some banks may want their Routing Transit Number in this field. Verify with your bank what information should be entered in this field.

The first position must be blank if you are entering a Bank Routing Transit Number.

If this account is to be used for EFT (or ACH), all transactions processed in the same run must be to the same bank (all GL numbers must have the same origin and destination ID).

Account Number at Bank

Enter the Bank Account number associated with the General Ledger Account number entered on the selection screen.

Destination Bank ID

The Receiving Depository Financial Institution is the bank upon which the funds are being drawn. This can be the same as the Origination Bank. To be valid, a record for this bank must be entered in the Bank ID Master.

Enter the Bank ID of the destination bank, or click the prompt to select from a list. The first position (left) must be blank. The last position (right) is the check digit and is calculated by the system.

Origin Status

Originating DFI |

Depository Financial Institution (DFI). Use this selection when the DFI is not a government entity. |

Fed Gov’t Entity |

Federal government entity. This selection is only used when the Originating DFI is a government agency. |

ICD Number

International Code Designators ( ICDs) as defined by ISO 6523 (Data interchange - Structure for the Identification of Organizations). ICDs are intended to designate a set of codes (such as bank identification codes or charge card numbers).

This entry will be placed in the 5 record, position 41. Valid entries include the numbers 0 through 9. Position 41 will default to a 1 if the ICD field is left blank or contains a zero.

Click the prompt and select a number (1 thru 9) that will precede the Originator ID number in the ACH and EFT files. A selection from this field will have effect only if the Payroll default, ACH Originator ID, is set to 3 (“Fed ID Preceded by 1”).

Admin | Application Installation | Setup Default Values | Payroll option, screen 4

ACH End of Line X

Select this option to Insert an X at the end of the 1 and 9 records.

The next 3 fields are used to override the current Company/Division and General Ledger account used on the ACH Header record.

ACH File Header Company Number/ACH File Header Division Number

Accept the Company/Division used at login, or make new entries to be used on the Header Control record for ACH.

ACH File Header General Ledger Number

Enter the General Ledger Number to be used on the ACH Header Control record for the above Company/Division.

Company Data to Print on Checks

These fields are populated with the Company Name and Address from the company defaults and can be overwritten.

This information will be used only when the Payroll default, Print on Cheques: Company Name, is set to Y, or the Company Name on Cheques option (above) is selected.

FORMation Laser Control

These fields will display when the eForms application is installed. Both Forms ID and Output Queue fields are required.

Not Over Dollar Limit

Limits are setup in eForms. If the dollar amount of a check falls below, or is equal to, the limit imposed the signature image associated with this limit will print on the check if the user has been granted the necessary permission. You can specify the User Data, Forms ID and the Output Queue for checks that are not over the dollar limit set in eForms.

Over Dollar Limit

If the dollar amount of a check is greater than Limit 1, and less than or equal to Limit 2, the signature image associated with Limit 2 will print on the check if the user has been granted the necessary permission. You can specify the User Data, Forms ID and the Output Queue for checks that are over the dollar limit set in eForms.

Click the eForms tab to display the eForms Detail screen. |

Click to process these entries and return to the Employer Bank Account Master Selection screen. |

|

Click to return to the Main Menu without saving changes. |

|

Click to delete the current record. |

|

Click to return to the Employer Bank Account Master Selection screen without saving changes. |

Bank Account Master Maintenance eForms

The eForms application provides a way to modify document templates, affect the routing of distributions and view their status, thereby providing control over eForm documents that are created in eCMS and sent to a network queue. For A/P and Payroll check runs this requires providing bank information and determining which signatures will display on checks, and specifying the dollar limits above which more than one signature will be required or no signature will be required.

Employer Bank Account Master eForms screen

Bank Information

These fields are populated from the Bank Account Master and may be overridden.

Signature on Zero Check

Select this option to have signatures printed on voided checks (i.e. Direct Deposit).

Security Check Printing

This field is provided for Formation users only

Print Logos/Logo Macro

Select this option to print logos on checks using the Check Secure box. Enter the macro in the Logo Macro field.

Print Dollar on MICR

The MICR line is an area at the bottom of a check that uses special ink and fonts to display such information as the Check Number, Bank ID, and Check Amount. The Check Amount can be included when the check is initially printed, or left blank and filled in later when processed by the bank.

Select this option to include the Check Amount on the MICR line when it is printed

Print Signature

Select this option to run signed checks.

Signature 1 and 2

The person performing the check run will need certain permissions in order to attach the required signatures. Signature and Permission records are set up in the Signature Vault section of System Administration.

Admin | Security | Signature Vault

The Signature 1 and Signature 2 fields are used to designate which signatures will be used for the limits set in the Signature Limit 1 and Signature Limit 2 fields described below.

Click the prompts and select the Signature Permission records required to print their corresponding Signature files.

Signature Limit 1 and 2

Limit 1 |

If the dollar amount of a check falls below, or is equal to, the limit imposed by Limit 1, the signature associated with this limit will print on the check (provided the user has the necessary permission). If the dollar amount exceeds Limit 1, this signature image will not print and the check will be evaluated by Limit 2. |

Limit 2 |

If the dollar amount of a check is greater than Limit 1, and less than or equal to Limit 2, the signature associated with this Limit 2 will print on the check (provided the user has the necessary permission). Checks in amounts exceeding Limit 2 will be processed unsigned |

Check Number Prefix

Optional. Enter an identifier that will be used to group checks for tracking purposes.

Output Locations

Output Locations are set up in System Administration and they refer to the physical location of an e-mail server, or fax server. When set up, they show eForms where, and how, to direct a distribution. In addition to assigning Output Locations to templates, you can also assign them to individual users.

Admin | Application Installation | eForms Output Locations

Output Location Limit 1 and 2

Limit 1 |

If the dollar amount of a check falls below, or is equal to, the limit imposed by Limit 1, eForms will use Output Location 1. If the dollar amount exceeds Limit 1, Output Location 1 will not be used and the check will be evaluated by Limit 2. |

Limit 2 |

If the dollar amount of a check is greater than Limit 1, and less than or equal to Limit 2, eForms will use Output Location 2. |

Output Location 1 and 2

The Output Location 1 and Output Location 2 fields are used to designate which location will be used for the limits set in the Output Location Limit 1 and Output Location Limit 2 fields described above. Enter an Output Location 1 and 2, or click the prompts and select from a current list.

Output Location EFT

Enter the Output Location to be used for Electronic Funds Transfers, or click the prompt to select from a current list.

Click to process these entries and return to the Employer Bank Account Master Selection screen. |

|

Click to return to the Main Menu without saving changes. |

|

Click to return to the Employer Bank Account Master Selection screen without saving changes. |