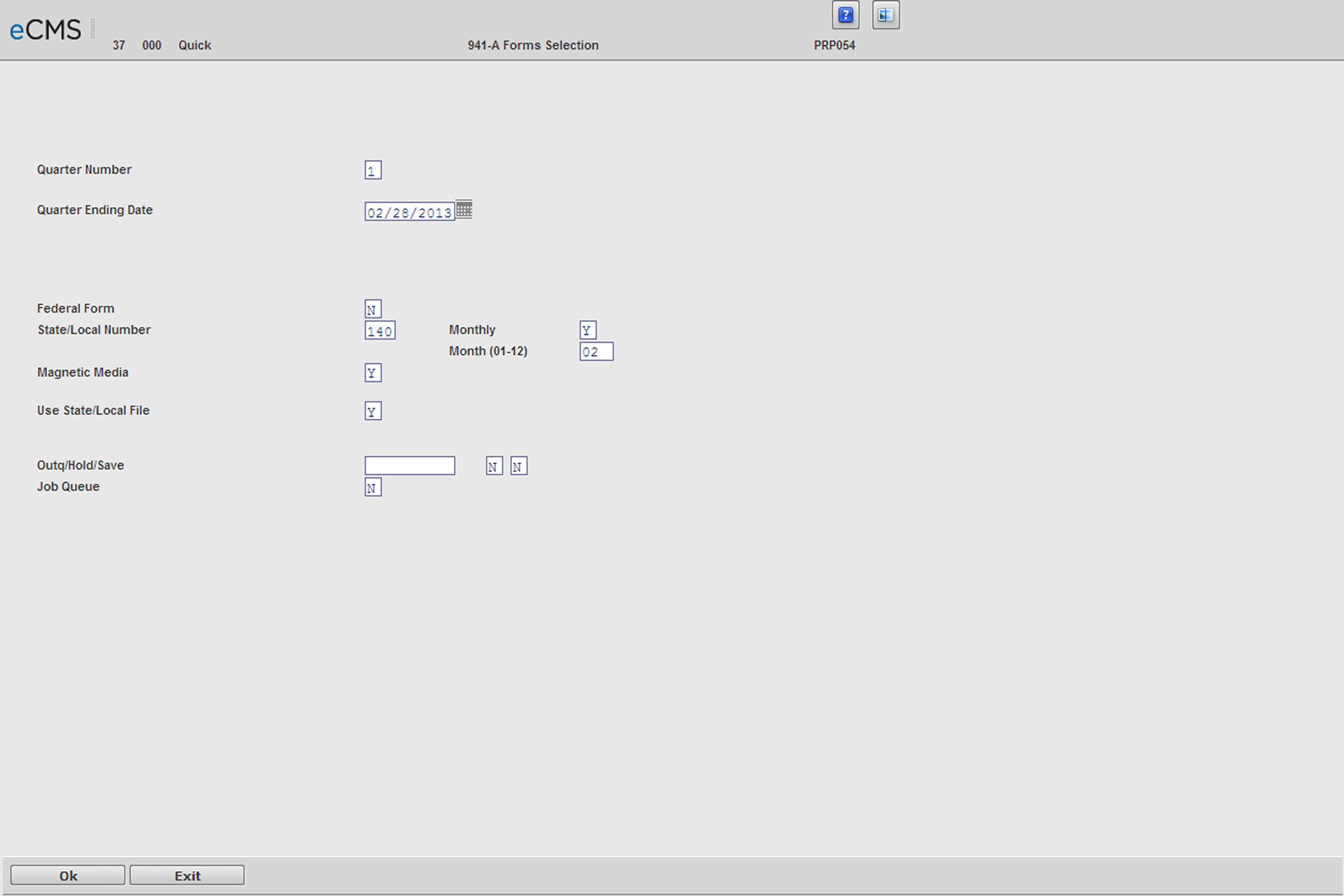

This menu option is used to run the 941 Forms required for quarterly state and local reporting. The information printed will differ according to the state or local taxing authority selected.

Quarter Number

Enter the number of the quarter for which you want to print reports. Valid entries are 1, 2, 3, or 4.

Quarter Ending Date

Enter the ending date for the quarter to be printed on the 941 Form.

Company Name Co/Div

Enter the Company/Division numbers you wish to process. This option is available for all Company/Division security only.

Include Co(s) Div(s) With Common Federal Id#

To consolidate employees across company/divisions, enter a federal ID number. This option is available for all Company/Division security only.

State/Local Number

If you entered a federal ID number in the box above, enter 000 for a state/local report. If you left the Federal ID box blank, enter the state or local code to be printed.

Monthly/Month (01-12)

These fields are used for Illinois Department of Employment Security monthly reporting and will display only if state number 140 was entered in the State/Local Number field.

If you are not doing monthly reporting, enter an N in the Monthly field and continue with Quarterly reporting.

If you are doing monthly reporting, enter a Y in the Monthly field, and enter the number of the month in the Month field below.

Magnetic Media

Enter Y to create the Magnetic Media file.

Use State/Local File

Y |

Use the state/local relationships you set up, using the State and Local File Maintenance procedure, to report local wages or taxes (or both) on 941 forms (or magnetic media). For example, for New York fourth quarter taxes, the total tax amount, which includes both state and local taxes, is required for every employee. Iin this case, you would set Use State/Local File to Y. |

N |

Do not use the state/local relationships |

Outq/Hold/Save

Enter an Outq identifier to send this report to a specific output queue. Leave this field blank to send the File Listing to the default output queue.

Enter a Y in the Hold field to place this report on hold in the default, or specified, output queue.

Enter a Y in the Save field to print the report, and then place it on hold in the default, or specified, output queue.

Job Queue

Y Process this report in the Job Queue.

N Process this report before other jobs in the Job Queue.

Click to process these entries and run the report. The system operator is prompted to change forms when the 941 Form is ready to be printed. Review the IBM Displayed Messages Guide for the correct responses to the system messages to change and align forms. When the messages are answered, the 941 Form is printed. If the field, Magnetic Media, is set to Y, the Magnetic Media screen below displays. |

|

Click to return to the Main Menu without processing entries. |

Note: The date of hire will print in the far right column if it occurs during the current year. The number of weeks worked in the quarter will also be printed.

Magnetic Media Selection screen

Magnetic Media Type

Select a Media type from the following list.

1 AS/400 diskette

2 Tape

3 PC diskette

Device ID

Leave blank for PC

Enter the device identification for the diskette or tape drive being used to spool the 941 reporting information to magnetic media.

File Label

Enter DKT941 for PC

Each taxing authority will dictate the appropriate data to be entered here for their magnetic media transmissions. Follow their directions exactly.

Click to process these entries and display the Magnetic Media Reporting Information screen (see below). |

|

Click to return to the Main Menu without processing entries. |

Magnetic Media Reporting Information screen 1

Transmitter

Name/Address/City/State/Zip

Enter this information when the Transmitter differs from the Employer.

When you specify California (50), then you will need to specify a California Quarterly DE 6 Wage Plan Code on the ensuing screen.

Foreign Postal Code

Enter the name and address of the company which actually transmits (sends) the magnetic media. Make an entry here only if the name and/or location is different from the employer.

UI Paid Via EFT (Y/N) (Louisiana only)

This field displays only if 190 (Louisiana) was entered in the State/Local Number field on the 941 Forms Selection screen. If you set this selection to Y, then a 1 will display on the quarterly electronic file for employees that have worked the pay period that includes the 12th for each month of the specified quarter. A 0 will display on the quarterly electronic file for employees that have NOT worked the pay period that includes the 12th for each month of the specified quarter. This is checked 3 times, one time per month for the specified quarter.

Therefore, if an employee worked the pay period including the 12th for the first month of the quarter, but not the next two months, they would have a 1 for the first month, a 0 for the next month, and a 0 for the last month of the quarter. This information is obtained from the Payroll History file.

Transmitter Federal EIN

Enter your federal EIN number (supplied by the taxing authority).

Transmitter PIN#

Enter your PIN number (supplied by the taxing authority)

TLCN

This field is only required when Re-submission has been selected. Enter the Wage File identifier (WFID) that was supplied when the SSA notified you to resubmit.

Re-submission

Y This is a re-submission, in response to an SSA notification.

Multiple Counties/Multiple Locations

Y Required for some employers in the State of New Mexico. Answer Y if you are required to report by multiple counties and/or locations.

Transmitter Same As Employer

Y The name above is the employer.

Preparator Name/Title

An entry is required only for the State of New Hampshire. Enter the name of the person responsible for the preparation of your 941's.

Employee Master Name Code

F The employee's first names are first in the record.

S The employee's surnames (last names) are first in the record.

Quarter Ending

Enter the month and year of the quarter ended.

Payment Year

Enter the year in which the reported wages were paid.

Click to process these entries and display the Magnetic Media Reporting Information screen 2 (see below). |

|

Click to return to the Main Menu without processing entries. |

Magnetic Media Reporting Information screen 2

Send File Information To

Name/Address/City/State/Zip/Foreign Postal Code

Enter the name and address to which 941 forms and information should be mailed to. Make an entry only if the name and/or location will be different from the employer.

California Employee Wage Plan (S,U,J,L,R,A,P)

This field will only display if you specified California (50) on the previous screen. Enter one of the following California Quarterly DE 6 Wage Plan Codes:

S |

The employee is covered under a state plan for both unemployment insurance and disability insurance. |

U |

The employee is covered under a department approved voluntary plan for disability insurance and the state plan for unemployment insurance. |

J |

The employee is covered under the state plan for disability insurance only (exempt from unemployment insurance). |

L |

The employee is covered under a voluntary plan for disability insurance only (exempt from unemployment insurance). |

R |

The employee is covered under the state plan for unemployment insurance, but is exempted from disability insurance. This applies only to sole stockholders who claim an exemption under Section 637.1 of the California Unemployment Insurance Code (CUIC); to third party sick pay recipients who claim an exemption under Section 931.5 of the CUIC; and to employees claiming a religious exemption under Section 2902 of the CUIC. The employee must file and exemption certificate for the religious exemption. |

A |

The employee is covered under the state plan for unemployment insurance. This applies only to public entity employees. |

P |

The employee is covered for personal income tax withholding purposes only. |

Note: Do not leave the wage plan code field blank.

Contact Name

Enter the name of the contact person for your company.

Note: Depending on your state requirements, enter a contact name or a valid email address in the Contact Name field. If your state requires an email address in this field, and you do not enter a valid address, you will receive an error and not be allowed to continue this process until the information is entered correctly.

Contact Phone Number

Enter the phone number of the contact person for your company.

Click to process these entries, copy the 941 data to your magnetic media, and display the Magnetic Media Reporting Information screen 3 (see below). |

|

Click to return to the Main Menu without processing entries. |

Magnetic Media Reporting Information screen 3

Media reporting specifications

Media Type

Enter the number (1- 8) that corresponds with the media type being used.

Note: Option 1: 8 Diskette 1 = A one-sided diskette formatted with single-density recording. Option 2: 8 Diskette 2 = A two-sided diskette formatted with double-density recording.

Tape specifications

Labeling

Enter the tape label type.

Density

Select the tape density type.

Blocking Factor

Not Used

Click to process these entries and and save the file to media. |

|

Click to return to the Main Menu without processing entries. |

Magnetic Media Reporting Information screen 4

Click to close the message screen. |

|

Click to return to the Main Menu without processing entries. |