Use this option to calculate the amount of additional actual cost to be paid, or the standard rate increases to be posted to Job Cost and the General Ledger.

Create P/R Work File

This option selects records from the Retroactive Pay file for addition to the Payroll Work file, and calculates:

The amount of additional actual wages to be paid and charged to Jobs.

- and/or -

The amount of standard cost values to be accrued as additional Job Cost.

Processing must be completed using the procedures in Payroll Processing (see, Processing).

Prepaid payroll check transactions are only processed to effect Standard costs. Pay Rate adjustments are not processed for prepaid checks. In the event that they need to be processed, the transaction must be manually added to the Payroll Work file using Payroll Entry.

Only Union Benefits coded as follows will be processed:

Percentage Benefits: Include in Gross = Y and Include in Net = N

This is the total burden amount on the incremental amount of gross pay. The incremental burden amount on the old base pay is calculated by the Retroactive Burden procedure.

Percentage Benefits: Include in Gross = Y and Include in Net = Y.

This is the total burden amount on the incremental amount of pay at the new or same percentage rate. The incremental benefit amount based on the old rate of pay is not automatically calculated, it must be manually calculated and processed as a taxable adjustment as part of a regular payroll run.

Per Hour Benefits: Include in Gross = Y and Include in Net = Y

This is the incremental amount of the burden increase based upon the number of hours worked.

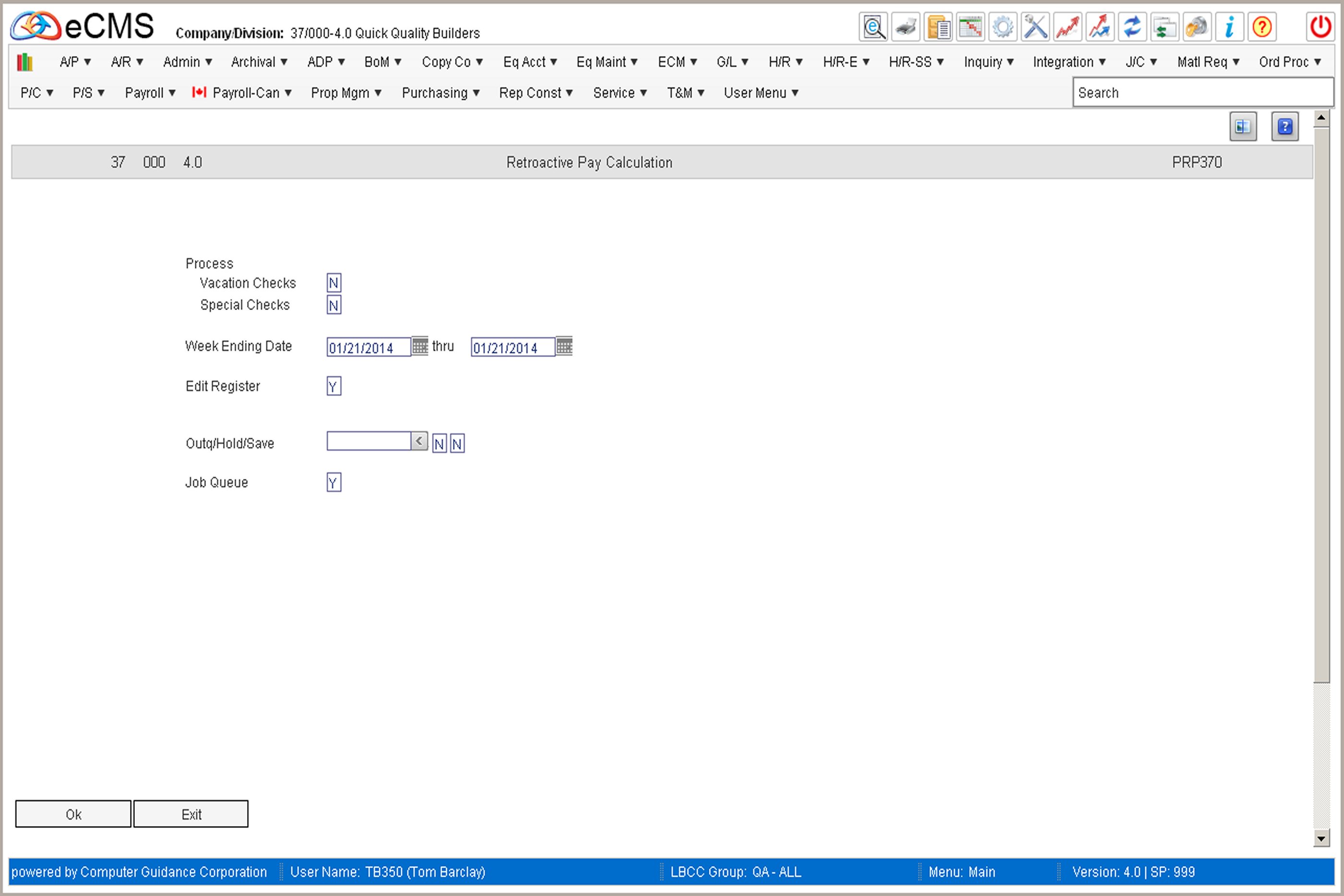

Retroactive Pay Calculation Selection screen

Process

Y |

Include Vacation and/or Special Checks in the Payroll Work File for retroactive pay calculation purposes. |

N |

Do not include Vacation and/or Special Checks in the Payroll Work File for retroactive pay calculation purposes. |

Week Ending Date

Use these fields to define a range of Payroll transactions for which to calculate Retroactive Pay. Records are selected by Week Ending date, and not Processing Journal date.

Processing periods can include one week at a time, one month at a time, all records at one time, etc. The weeks selected depend upon how the additional payroll costs will be reflected in the General Ledger and Job Cost records.

Edit Register

Y |

Print an edit register of the transactions selected for retroactive pay processing. |

N |

Do not print an edit register of the transactions selected for retroactive pay processing. |

Outq/Hold/Save

Enter an Outq identifier to send this report to a specific output queue. Leave this field blank to send the File Listing to the default output queue.

Enter a Y in the Hold field to place this report on hold in the default, or specified, output queue.

Enter a Y in the Save field to print the report, and then place it on hold in the default, or specified, output queue.

Job Queue

Y To put this pay calculation in the Job Queue.

N To print this pay calculation before other jobs in the Job Queue.

Click to calculate Retroactive Pay, update the Payroll Work file, and print an Edit Register (if selected). |

|

Click to return to the Main Menu without processing these entries. |

Complete Processing

Retroactive pay is now ready to be processed through Payroll Processing (see Processing).

The Payroll Proof procedure includes a Retroactive option that can be used to select records for retroactive pay. Retroactive payroll records can not be included with regular payroll records in the same processing batch.

The following option is used to delete records in the Retroactive Payroll file after all retroactive payroll processing has been completed.

Delete Retroactive Payroll Records Selection screen

Date

Enter the Date thru which records in the Retroactive Payroll file should be deleted. The date used should be the Week Ending Date of the payroll transactions.

Transactions should be deleted only after all payroll processing has been completed for the retroactive transactions.

Job Queue

Y Process the Payroll File Delete in the job queue.

N Process the Payroll File Delete interactively.

Click to delete the selected records. |

|

Click to return to the Main Menu without processing these entries. |