This menu option is used to add, update or delete code records in the Local Master file.

A “Local” is any taxing authority, below the State level, for which payroll taxes must be withheld. Examples would be Cities, Counties, and Transit Districts. The Locals set up here will be assigned to payroll recipients (employees) through the Employer Master, and multiple Locals may be assigned to each employee.

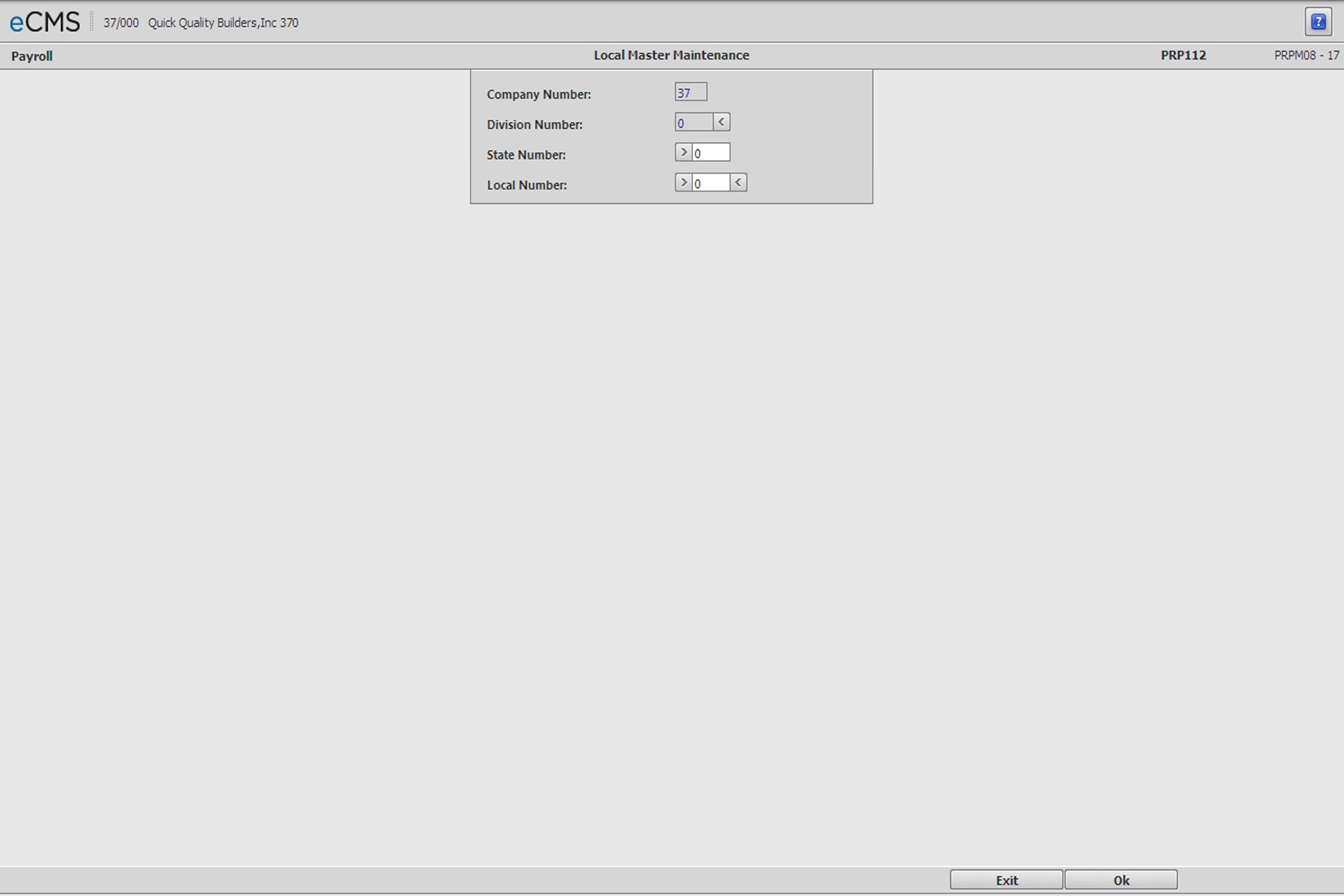

Company/Division Number

Accept the current Company/Division, or click the Division Number prompt to make new selections from a list.

State Code

Locals are state specific. Enter the state code for this local, or click the prompt to select from a list.

Local Number

Enter a Local Code to create a new code. To update an existing code click the prompt to select from a list. To create a new Local Code, a record must currently exist in the Distribution Master that has a Distribution Code of L, and a Distribution Number equal to the Local Code being created here. For information on setting up records in the Distribution Master, see Distribution Master Selection screen. Local codes must be numeric and no longer than three digits. The codes 0, 00, and 000, are not valid.

Click to process these entries and return to the Local Master Detail screen. |

|

Click to return to the Main Menu without saving changes. |

Local Name

Enter a name that will be used to identify this Local. Examples would include the name of a City, County, or Transit District.

Pennsylvania

The Local Name will appear on Pennsylvania Quarterly form and other reports. Local Tax ID must include relevant PSD code. Each code is six digits. Include any leading zeros. You must also enter state and county codes for reporting purposes.

Local Tax ID

Enter this Local’s Tax ID number.

Pennsylvania

For PA Act 32 reporting, enter a Political Subdivision Code. PSD codes identify the municipalities and school districts for each tax collection district.

State Code

The State/County combination will be validated against the County Master.

County Code

Must be set up in the County Master. This field is mandatory for Pennsylvania.

PA Act 32

Select this option for PA Act 32 reporting. Entries for Resident and non-Resident will be required for each code in the tax table.

Leave this option cleared for standard tax processing.

Click to process these entries and return to the Local Master Selection screen. |

|

Click to return to the Main Menu without saving changes. |

|

Click to delete the current record. |

|

Click to return to the Local Master Selection screen without saving changes. |