A record in the State Master file is required for every state for which payroll activity will be entered. The State Master controls Worker's Compensation, Liability Insurance premiums, and SUTA calculations.

This option is used to add, update, or delete records in the State Master file. Review the Distribution Master documentation before proceeding with State Master File Maintenance.

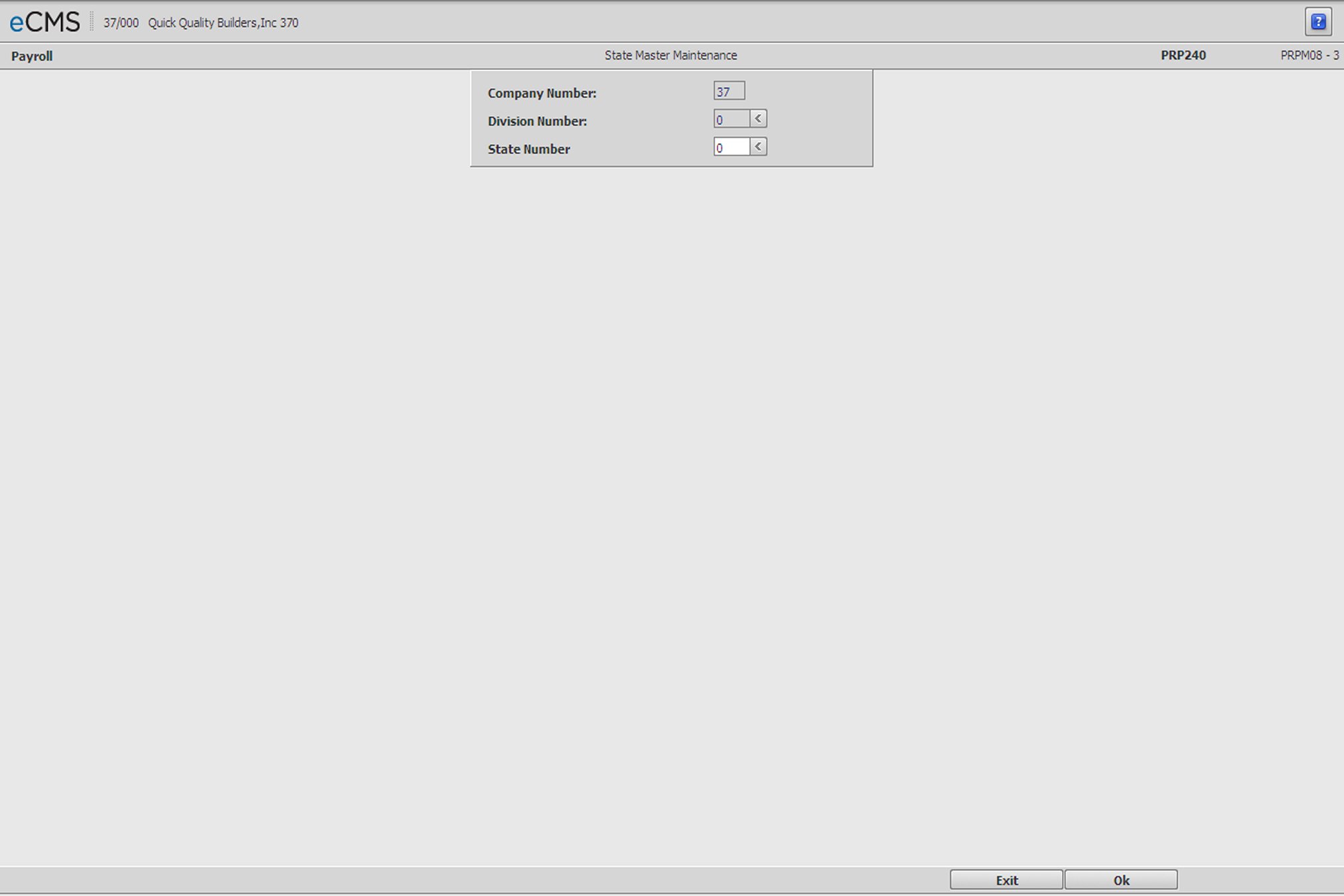

Access the screen by selecting State Master from the Maintenance 1 menu.

Company/Division Number

The Co/Div Numbers auto-fill from the login screen, and can be modified if needed.

State Number

Enter a State Number, or click the prompt to select from a list.

The State Number must currently be set up in the Distribution Master file. For information on setting up State records, see documentation for the Distribution Master.

Refer to the State and Territory Numbers and Abbreviations List below.

Click to process these entries and display the State Master Detail screen. |

|

Click to return to the Main Menu without saving changes. |

Enter the State Name.

941, W2 ID (State Identification Number)

Enter the State Identification Number assigned for 941 and W2 Income Tax Reporting. This number will be printed on W2 forms and 941 reports.

Unemployment ID

Enter the assigned Identification Number that is used to report SUTA (State Unemployment Insurance) for this State.

This number must be preceded by 000 for Texas magnetic media reporting.

Media Number

Enter the Media Number provided by the State. This number is required to be present on magnetic media.

Minimum Wage

Enter the current Minimum Wage rate.

Supplemental Info on Certified Report

Select this option to have supplemental information printed on the Certified Payroll report. Supplemental information includes the Benefit Rate per hour, the Paid to Designation, and the Total Benefits paid.

NAICS Code

These fields are used only for Wyoming or Alaska quarterly reporting magnetic media.

Enter the required NAICS code to report to Wyoming or Alaska for the selected Employee.

Coverage Type

U |

Unemployment |

W |

Worker's Compensation |

B |

Both |

Average Earnings/Exposure Limit

By default, Average Earnings is set to N and Exposure Limit is set to Calculated. All limit calculations are based on each pay period, earnings are not averaged over an earnings period.

Website

Enter the Customer’s website address.

Worker’s Compensation

Premium Basis

This field will determine if Worker's Compensation premiums are based on Dollars paid, or Hours worked. The State of Washington is the only state CGC is aware of that calculates Worker's Compensation based upon Hours worked.

Click the prompt and select one of the following codes from the drop-down list.

Dollar |

Insurance Premiums are based on Dollars Earned. Payroll reports will summarize on Total Dollars. |

Hour |

Insurance Premiums are based on Hours Worked. Payroll reports will summarize on Total Hours. |

Annual Base Wage

This field is used to calculate whether an employee has earned enough to qualify as having worked a week. The figure entered here will be divided by the pay frequency to arrive at the weekly amount.

Example: In New Jersey, an employee must earn $133.00 in a week to be included as a week of work. The correct entry in the Annual Base Wage field would be $6916.00, i.e., 133 x 52.

Include in Hourly Premiums

If Wage Rate Premiums are based upon hours worked:

Select the options that should be included when calculating the Wage Rate Premium.

Clear those options that should not be included when calculating the Wage Rate Premium.

Include in Earnings Premiums

If premiums are based upon wages earned, enter a code in each of the following fields to determine what type of pay is considered Covered Wages.

Overtime

Click the prompt and select which of the following methods should be used to define Covered Wages when calculating Overtime.

Include |

Include all Overtime. |

Omit |

Omit all Overtime. |

Regular Only |

Include only the Regular Earnings portion of Overtime. |

Other Pay

Click the prompt and select which of the following methods should be used to define Covered Wages when calculating Other Pay.

Include |

Include all Other Pay. |

Omit |

Omit all Other Pay. |

Regular Only |

Include only the Regular Earnings portion of Other Pay. |

Select which of the following options should be included when calculating the Premium Wage Rate. Clear those options that should not be included in this calculation.

|

|

Calculation Limits

For each of the Limits Categories listed below, premiums will be calculated as follows:

Annual |

Premiums are calculated based on the earnings per pay period until the employees Year-to-Date wages reach the Limit specified for each category. |

Pay Period |

Premiums are calculated based on a system calculated wage limit per pay period using the frequency code in the Employee Master file. See the following example. |

Pay Period Limit example

The system compares the Pay Period Wage Limit to the Pay Period Gross Wages and calculates the Workers Compensation on the Pay Period Gross Wages that are up to the Pay Period Wage Limit.

Frequency State Master |

/ |

Pay Period Employee Master |

= |

Wage Limit |

P = $20,000 |

/ |

52 (weeks) |

= |

$400.00 |

Using the above example, if the employees Pay Period Gross Wages (Weekly) is $500.00 the system will apply the appropriate W/C Rate on $400.00. If the Gross Wages is $375.00, the system will apply the W/C Rate on the $375.00.

Limit Type

Click the prompt and select either Annual or Pay Period wage limit to be used when calculating premiums.

Limit Categories

Enter the Annual Limit of earnings that apply to each of the following. When an employee's year-to-date wages reach this limit, the burden will no longer be calculated.

Workers Comp

Property Damage

Bodily Injury

Executive Office

Click to process these entries and return to the State Master Selection screen. |

|

Click to return to the Main Menu without saving changes. |

|

Click to delete the current record. |

|

Click to return to the State Master Selection screen without saving changes. |

State/Territory Numbers and Abbreviations List