This menu option is used to determine which W2 boxes the various Distribution Codes will be assigned. A Distribution Code Table has been included at the end of this section. Individual Distribution Codes are discussed in greater detail in Distribution Code Guidelines.

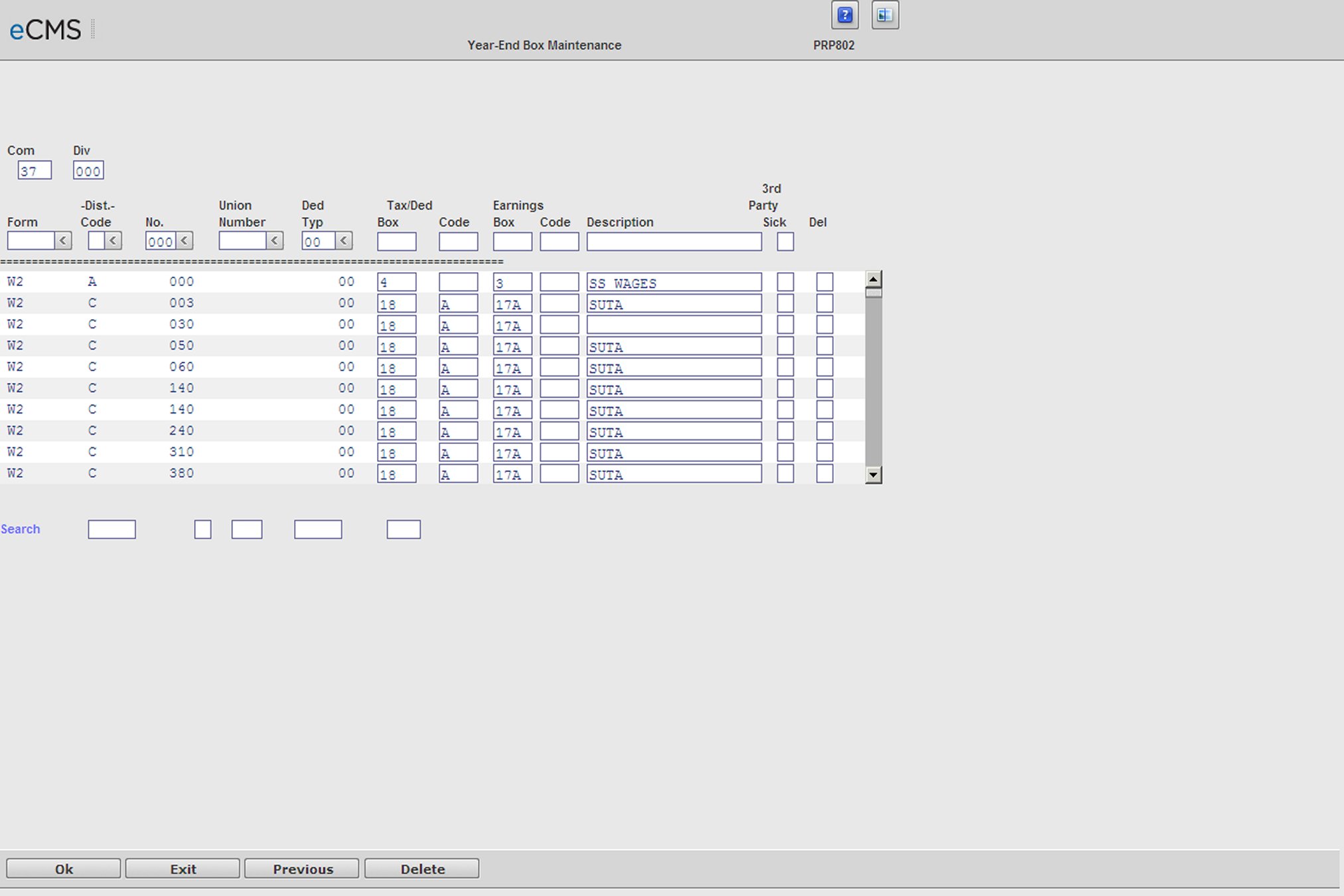

W2 Box Assignment Detail screen

Enter values for the following fields that apply to this W2 Box Assignment record.

Company/Division Number

Accept the current Company/Division, or make new entries.

Form

The entry in this field will always be W2.

Distribution Code/Number

Enter a Distribution Code and Distribution Number combination, as set up in the Distribution Master.

Union Number

Enter a Union Number as set up in the Union, or Distribution, Master (see Union Master).

Deduction Type

Deduction Types are used by Unions to break down the various fringe benefits (i.e. Vacation, Dues, Pension), and Human Resources 401K plans where the employees are allowed to spread their contributions across various investments (i.e. stock, bond, foreign).

Enter a Deduction Type when applicable.

Tax Deduction

Box

Enter the Box number to which this deduction should be assigned.

Code

Enter a Code number for the above Box assignment when applicable.

Earnings

Box

Enter the Box number to which these earnings should be assigned.

Code

Enter a Code number for the above Box assignment when applicable.

Description

Enter a Description for this Box assignment.

3rd Party Sick

Select if Sick pay was paid by someone other than employer (for example a Trust Fund, or an Insurance Company).

Del

To delete records, select the Del option for the records, and then click DELETE.

Search

The fields in the Search area are equivalent to the first 5 fields in the entry area - Form, Distribution Code, Distribution Number, Union Number, and Deduction Number. Enter search criteria in these fields and click OK. The table will reposition on the record containing, or most closely approximating, this search criteria.

Click to process these entries and create the W2 Box Assignment record. |

|

Click to return to the Main Menu without saving changes. |

|

Click to delete the current record. |

|

Click to return to the Main Menu without saving changes. |

Distribution Code Table

Distribution Code |

Description |

Distribution |

Union Number |

Deduction Type |

Prerequisites |

A |

FICA (Social Security) |

000 |

00000 |

00 |

|

B |

FUTA |

000 |

00000 |

00 |

|

C |

SUTA |

State Number * |

00000 |

00 |

|

D |

Adjustments |

Dist. Number ** |

00000 |

00 |

|

F |

Federal |

000 |

00000 |

00 |

|

G |

FICA (Medicare) |

000 |

00000 |

00 |

|

H |

H/R Benefit/Deduction |

Dist. Number ** |

00000 |

00 (4)*** |

Check Types States Locals |

I |

Comp Time Earned |

000 |

00000 |

00 |

|

J |

Comp Time Burden |

000 |

00000 |

00 |

|

K |

Earned Income Credit |

000 |

00000 |

00 |

|

L |

Local |

Local Number ** |

00000 |

00 |

|

M |

Employee Deduction |

Dist. Number ** |

00000 |

00 |

Check Types States Locals |

S |

State |

State Number * |

00000 |

00 |

|

P |

Tips Credited |

000 |

00000 |

00 |

|

R |

Tips In Excess |

000 |

00000 |

00 |

|

T |

State Disability |

State Number * |

00000 |

00 |

|

U |

Union |

000 |

Union * |

00 (3) * |

|

V |

W/C Employee Portion |

State Number * |

00000 |

00 |

|

W |

W/C Insurance |

State Number * |

00000 |

00 |

|

Distribution Table Key |

|

| * | Required |

| ** | Required - User Defined |