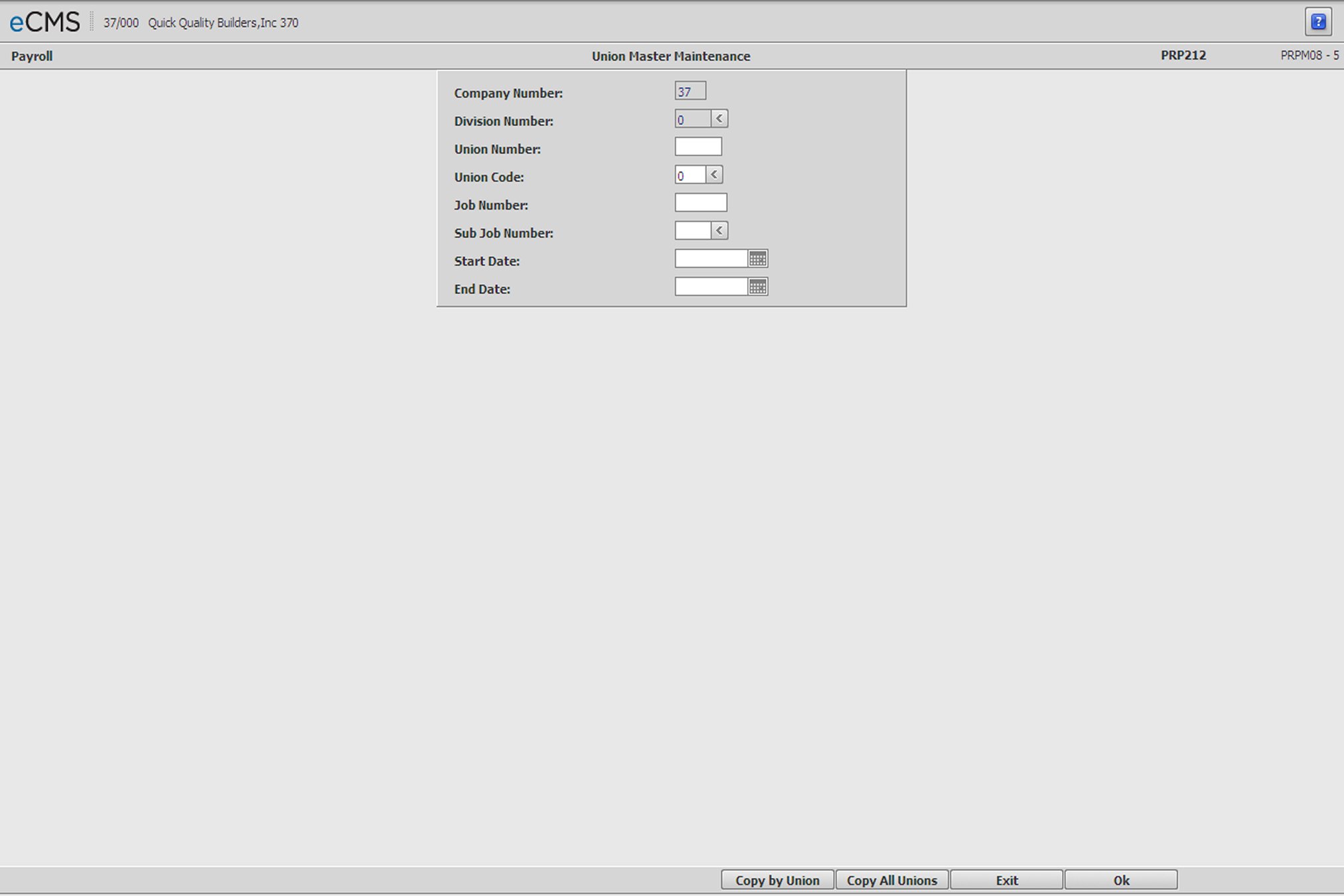

A Union Master record is required for each Union Deduction or Benefit. Union Numbers can be set up either here or in the Distribution Master, however Union Deduction Types must be set up using the Distribution Master (Distribution Master Union Benefit/Deduction Entry screen).

This menu option is used to add, delete or update records in the Union Master file.

Note: Union Numbers and Deduction Type Codes must have previously been set up in the Payroll Distribution file with one exception - Deduction Type 0 codes. Type 0 codes are description only records which assign a name and/or local number/description of the union to the user defined Union Code.

From the Main menu, select Payroll, and then File Maintenance, and click Union Master.

Union Code default description records (code 0) must be set up prior to setting up other Union Codes. Certain reports require these descriptions for processing.

Note: Description records are not set up in the Payroll Distribution Master file.

Company/Division Number

Accept the Company/Division used at login or click the Division Number prompt to make new selections from a list. The Company/Division Numbers are used for Inter-company transactions at the detail level.

Union Number

Enter the number you have assigned to this Union. This Union Number must have previously been set up in the Payroll Distribution file.

Union Code

A Union Code is the Union Masters equivalent of the Deduction Type that was set up and associated with this Union Number in the Distribution Master file. The number of Union Codes (or Deduction Types) that can be set up for each Union is determined by the value of the Max Ded Payroll default.

Enter a valid Union Code, or click the prompt to select from a list. These numbers must have already set up Distribution Master file.

The Union code is set to 0 by default. If you accept this entry by clicking OK the Union Master Description screen will display.

If you change the Union code to something other than the default (0), the Union Master Detail screen will display when you click OK.

Job/Sub Job Number

These fields are only displayed if the Use Job Payroll default is set to Y.

Admin | Application Installation | Setup Default Values Payroll option - second page

Enter a valid Job/Sub Job number if this Union Master record applies to a specific job. Click the Sub Job prompt to make these selections from a list.

Start Date/End Date

Not Required.

If you use date-sensitive pay rates, enter the Start Date and End Date for this Union Master entry. The system uses these dates for various union calculations.

If you do not use date-sensitive pay rates, enter all 9s in the End Date field, and the Start Date field will default to zeros.

If you enter a date range that conflicts with that of an existing Union Master record an error message will be generated. You must resolve the conflicting date ranges before continuing.

We recommend you use print screens before deleting these entries and/or print a listing of the Union Master from the Payroll File Listings menu.

Union Calculation Notes

For hourly amounts, the Week Ending date is used to calculate a date for each of the 7 days of the week.

These dates are used in conjunction with the day number to calculate union deductions and employer paid benefits during payroll entry. By doing so, the system can get a new rate during the week for each record.

For a day number of zero, the system will use day seven (7) to calculate the pay rates.

Union deductions and employer paid benefits with fixed or percentage amounts are calculated by week ending date. The system does not use the above daily logic to calculate union fixed or percent amounts.

Click to display the Union Master Description screen. |

|

Click to return to the Main Menu without saving changes. |

|

Click to display the Copy All Unions screen. |

|

Click to display the Copy by Union screen. |

Union Master Description screen

This screen displays if you entered a Union Code of 00 on the Union Master Selection screen.

Description

Enter the a Description for this Union that will display on various reports. A commonly used entry is a combination of the Union Name and Number.

Reciprocity

Select this option to indicate that this Union has a reciprocal agreement with another Union, which then makes it possible for employees to work outside their affiliated Union. Union Benefits will be calculated based on the reciprocal agreements.

Note: This field displays only when the Union Code field is set to the default value 0, and the Payroll default, Union Reciprocity, is set to Y.

Admin | Application Installation | Setup Default Values Payroll option - second page

Click to process these entries and return to the Union Master Selection screen. Enter a Union Code on that screen and click OK to display the Union Master Detail screen. |

|

Click to return to the Main Menu without saving changes. |

|

Click to delete the current record. |

|

Click to return to the Union Master Selection screen without saving changes. |

This screen displays if you entered anything other than a Union Code of 00 on the Union Master Selection screen.

Through

Enter a new through date, if necessary, or click the icon to make this selection from a calendar.

Note: If a new through date is entered, it cannot conflict with existing records or an error message is returned. You cannot continue until a valid through date is entered.

Description

Enter a Description for this Union that will print on various reports. A commonly used entry is a combination of the Union Name and Number.

Benefit Deduction / Calculation

Fixed Amount

If the amount of an employee paid Union Benefit/Deduction is a fixed amount each pay period, enter that amount.

- or -

Percent of Gross Rate

If the Union Benefit/Deduction is based on a percentage of gross wages for the pay period, enter that percentage.

Cap Multiplier

This multiplier is used in conjunction with the Current % of Gross for Union Deductions. The system will calculate the deduction based on the Cap Multiplier and compare the deduction amount with the normal calculation based on the Union Master file. The lowest calculated deduction amount is taken.

Earnings = $480.00 Hours Worked=40 Cap Mult.=.5769

Gross Earnings/Hours Worked = Rate Per Hour

$480.00/40=$12.00

Rate Per Hour X Cap Multiplier = Maximum Cap

$12.00 * .5769 = $6.92

Normal Calculation of the Dues Per Union Master

Gross Earnings X Percent of Gross = Dues

$480.00 * 1.3% = $6.24

Dues Deducted = $6.24

Note: Description records are not set up in the Payroll Distribution Master.

- or -

Regular Hour Rate

If this Union Benefit/Deduction is based on a Fixed Rate per Hour, enter the hourly rate that applies to Regular Hours.

Overtime Hour Rate

If this Union Benefit/Deduction is based on a Fixed Rate per Hour, enter the hourly rate that applies to Overtime Hours.

Other Hour Rate

If this Union Benefit/Deduction is based on a Fixed Rate per Hour, enter the hourly rate that applies to Other Hours.

- or -

Percent of Regular Pay

A percentage entered in this field will be multiplied by the Employees regular pay rate, for that Class/Type, to determine the amount of the Union Benefit/Deduction. The result will then be deducted, or included as a benefit, once during the pay period.

Example: An employee is in class 100/JR and makes $10/hour. The Union Deduction is set up as 20% in the Percent of Regular Pay field. When the Payroll Register is run for that pay period, a $2 deduction will be assessed on the first hour of work. If the employee changes classes during the week, to 100/FR for example, then another $2 deduction will be assessed.

Percent of Overtime Pay

If Overtime hours are worked, a percentage rate entered in this field will be multiplied by the Employee’s Other pay rate for that Class Type. The Union Benefit/Deduction amount will be calculated as the sum of the values for Percent of Regular Pay, Percent of Overtime Pay, and Percent of Other Pay. The result will then be deducted, or included as a benefit - once during the pay period.

This field will be used with the Percent of Regular Pay field to determine the Benefit/Deduction. When hours for a pay type are worked, each field containing a percent entry will be calculated as follows:

Percent X Pay Rate

The calculations for these three Percentage fields (Percent of Regular Pay, Percent of Overtime Pay, and Percent of Other Pay) will then be summed to calculate the Benefit/Deduction.

Percent of Other Pay

If Other hours are worked, a percentage rate entered in this field will be multiplied by the Employee’s Overtime pay rate for that Class Type. The Union Benefit/Deduction amount will be calculated as the sum of the values for Percent of Regular Pay, Percent of Overtime Pay, and Percent of Other Pay. The result will then be deducted, or included as a benefit - once during the pay period.

This field will be used with the Percent of Regular Pay field to determine the Benefit/Deduction. When hours for a pay type are worked, each field containing a percent entry will be calculated as follows:

Percent X Pay Rate

The calculations for these three Percentage fields (Percent of Regular Pay, Percent of Overtime Pay, and Percent of Other Pay) will then be summed to calculate the Benefit/Deduction.

Maximum

Amount

If the Union Benefit/Deduction is restricted to a maximum number of wages, or hours, over a certain period (Pay Period, Month, or Year), enter that number in this field.

Decimal places are ignored if the Frequency option is set to Year.

Code

Click the drop-down prompt and select the Unit in which the Maximum Amount will be measured.

Dollars |

The Maximum Benefit/Deduction will be measured in Dollars. The Frequency option, Year, cannot be used when this option is selected. |

Hours |

The Maximum Benefit/Deduction will be measured in Hours. |

Frequency

A Deduction Frequency code determines at what point a deduction will be taken from the employee's paycheck, or a benefit will accrue for payment. The Week Number used in payroll entry and the Frequency code entered here are compared to determine if the deduction, or benefit, should be taken or accrued during each pay period. Code 9 deductions (deductions with a Frequency code of Monthly) must be cleared by running the option on the Monthly Processing Menu at the end of each period. This will allow the deduction to be taken the next period.

Click the prompt and select a Frequency code from the drop-down list.

Pay Period |

The Maximum Benefit/Deduction will be calculated per Pay Period. |

Month |

The Maximum Benefit/Deduction will be calculated per Month. |

Year |

The Maximum Benefit/Deduction will be calculated per Year. This option cannot be selected when the Maximum Amount is set to be measured in Hours (Code option = Hours). |

The Master record for a new employee must be entered during a period prior to running the Clear Union Deduction Code option for this benefit/deduction to calculate in the next month’s processing. If an employee is entered during a period after the Clear Union Deduction Code option, the employee will not process for this benefit/deduction until the next time the file is cleared.

Reduce Code

Enter the Benefit/Deduction number that is to be reduced. This code applies to employer paid benefits or employee deductions.

Example: Assume an Employee receives a fixed benefit (01) of $25.00 per pay period, and a second fixed benefit is issued (02) for $15.00. If the Reduce Code for benefit 01 is set to 02, the first benefit is reduced by the second, so that benefit 01 is now $10.00 and benefit 02 is $15.00. The Employee continues to receive the same fixed amount.

Cutover Percent

A Cutover Percent is an employer paid benefit which will cutover to taxable wages, from non-taxable. This percentage is used to limit the non-taxable portion of the benefit, and is applied to the current Gross Wage Rate per hour. Any benefit amount that exceeds this calculated limit is converted to a taxable benefit and is paid to the employee. This method applies only to R type benefits.

Frequency Code

A Deduction Frequency code determines at what point a deduction will be taken from the employee's paycheck, or a benefit will accrue for payment. The Week Number used in payroll entry and the Frequency code entered here are compared to determine if the deduction, or benefit, should be taken or accrued during each pay period. Deductions with a Frequency code of Monthly must be cleared by running the option on the Monthly Processing Menu at the end of each period. This will allow the deduction to be taken the next period.

Click the prompt and select a Frequency code from the drop-down list.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: The master record for a new employee must be entered prior to running the Clear Union Deduction Code option. This allows Benefit/Deduction to calculate in the next months processing. If an employee is entered during a period after the Clear Union Deduction Code option has been run, this benefit/deduction will be processed for that employee the next time the file is cleared.

Benefit/Deduction Code

The Benefit/Deduction code determines if this is an Employer Paid Benefit, or an Employee Paid Deduction. Click the prompt and select one of the following from the drop-down list.

Deduction

Benefit

Taxable (Benefits Only)

Select this option to have this Union Benefit excluded from the Employees taxable gross. This option must be selected if the Union Deduction is taxable for FICA only.

Deductions only

The Distribution Master file has a Federal Exempt Withholding Tax Code option that can be set to:

|

|

|

|

See Distribution Master - Union Benefit/Deduction Entry screen for more information.

If the Taxable option is not selected on this Union Master record, then the Federal Exempt Withholding Tax Code option in the Distribution Master must be set to Taxable.

If the Distribution Masters Federal Exempt Withholding Tax Code option is set to an option other than Taxable (Exempt FIT, Exempt FIT/FICA/FUTA, or Exempt FICA/FUTA), then the Taxable option on this Union Master record must be selected.

Note: The next field, Include in Gross, must be selected if this is a Taxable Employer Paid Benefit.

Include in Gross

Select this option to include the Union Benefit in the Employee's gross pay as additional compensation. All taxable Employer Paid Benefits must have the Include in Gross option selected.

Include in Net

This option is used to include a Union Benefit in an employee's gross pay, tax it, and then:

Deduct it, and pay it to the union.

- or-

Do not deduct it, and pay it directly to the employee.

Select this option to pay this Union Benefit directly to the employee without deducting it from Net pay.

Clear this option to deduct the benefit that was included in the employee's gross pay as a union deduction.

Gross Pay Code

For deductions or benefits based upon a percentage of gross wages, select a code to indicate on which type of pay the Benefit/Deduction is based:

|

All Hourly Gross |

|

All Hours at the Regular Hourly Rate |

|

Regular Gross Only |

|

Regular and Overtime Gross Only. Other Gross is excluded. |

|

All benefits flagged in the Distribution Master where the code is not 0=Not Exempt, accumulate. Codes 1, 2, or 3 in the Distribution Master, for instance, will accumulate. Note: All benefits with a Union Code that is set lower than the one assigned this Special Calculation Code will accumulate. These accumulated FWT benefits are then subtracted from the gross wages.

Example: Union 500

Has the following Deduction Codes set with the dollar amount listed: 001 = $10 002 = $10 003 = $20 004 (Special Calculation Code) = $30 The above amounts total = $70

Gross Wages = $1,000 - $70 = $930 x % of Gross Calculation. If you have a gross of $1,000, you then subtract the $70 from the gross, leaving $930, which you then multiply by the Special Calculation code amount. The percent of gross calculation will then be applied on the amount derived in the example above ($930). |

|

Overtime Gross Only |

|

Other Gross Only |

Include Non-Hourly Benefits

Select this option to include other Benefits/Deductions in the Gross Pay used when calculating this Benefit/Deduction. The Benefits/Deduction included will be those that have the Non-Hourly Benefit option selected (see this field description below).

Update Monthly Union File

This option allows you to use Union processing for transactions that are not associated with a Union. Transactions such as Miscellaneous Income, Car Allowance, etc., can be set-up in the Union Master file, but not included when the Monthly Union file is updated.

Select this option to include this Benefit/Deduction in the Monthly Union file.

Clear this option to not include this Benefit/Deduction in the Monthly Union file.

Detail on Summary

The Summary Union Report only prints the total of earnings, hours and benefits for the deductions unless a benefit is selected as Detail on Summary. For information on Summary Union Reports see, Union Report Selection screen.

Select this option to have information for this Deduction code included on the Union Report. This option can be selected for only one Benefit/Deduction per Union.

Include in Workers Comp Calc

Various options can be selected in the State Master file that should be included in Earnings Premiums. If the Employer Paid Benefits option in the State Master is selected, the Include in Workers Comp Calc option controls whether Benefits are included in that calculation.

Note: The Home/Work Code field displays only if the Reciprocity option is selected in the Union Master Description record (see, Union Master Description screen).

Click the prompt and, from the drop-down list, select the option that best describes the relationship between the Employees and this Union.

Home |

Employees are under direct contract with this Union. |

Work |

This Union has an agreement with a Home Union. |

Both |

Includes both instances above. |

This field makes it possible for employees to work outside their affiliated Union when that Union has a reciprocal agreement with another Union. Union Benefits will be calculated based on the reciprocal agreements.

Union Master Description Screen - Reciprocity Option Selected

Union Code |

Benefits If |

Benefits If |

Benefits If |

Benefits If |

Benefits If |

||||||

Home |

Work |

Home |

Work |

Home |

Work |

Home |

Work |

Home |

Work |

Home |

Work |

(100) |

(200) |

(100) |

(200) |

(200) |

(100) |

(100) |

(100) |

(100) |

(-) |

(-) |

(200) |

1 |

1 |

X |

– |

X |

– |

X |

– |

X |

– |

– |

– |

1 |

2 |

X |

X |

– |

– |

X |

– |

X |

– |

– |

X |

1 |

3 |

X |

X |

X |

– |

X |

– |

X |

– |

– |

X |

2 |

1 |

– |

– |

X |

X |

– |

X |

– |

– |

– |

– |

2 |

2 |

– |

X |

– |

X |

– |

X |

– |

– |

– |

X |

2 |

3 |

– |

X |

X |

X |

– |

X |

– |

– |

– |

X |

3 |

1 |

X |

– |

X |

X |

X |

– |

X |

– |

– |

– |

3 |

2 |

X |

X |

|

X |

X |

– |

X |

– |

– |

X |

3 |

3 |

X |

X |

|

X |

X |

– |

X |

– |

– |

X |

Union Master Description Screen - Reciprocity Option Cleared

Union Code |

Benefits If |

Benefits If |

Benefits If |

||||

Home |

Work |

Home |

Work |

Home |

Work |

Home |

Work |

(100) |

(200) |

(100) |

(200) |

(200) |

(100) |

(200) |

(100) |

Not Used |

X (all) |

X (all) |

X (all) |

||||

Include in 401K Calc 7

Select this option to allow taxable Union Benefits to be included as wages subject to 401K and/or in the calculation of Type of Gross=7 '% of gross' deductions.

If this option is not selected, taxable union benefits as wages will not be subject to 401K.

Non-Hourly Benefits

Select this option to include this Benefit in the Gross Pay used when calculating other Benefits/Deductions that have the Include Non-Hourly Benefits option selected (see field description above).

Benefit Class

Enter the Benefit Class. Employees assigned the same Benefit Class code in the Employee Master will be eligible for that Benefit/Deduction, and the Benefit/Deductions that have not been assigned to a Benefit Class.

Employee Types

Include/Omit Code

Click the prompt and, from the drop-down list, select the types of Employees to include or omit from this Union Benefit/Deduction.

Include All Types

Include Listed

Omit Listed

- or -

Enter an I (Include), or an O (Omit) the Employee Types list in (maximum of 10) for this Union. Benefit/Deduction

Union Stamps

Paid in Stamps

Click the prompt and select an option from the drop-down list.

Yes |

Deduction is paid in Union Stamps |

No |

Deduction is not paid in Union Stamps. |

Print on Stub |

Deduction is paid in Union Stamps, and the amount is printed on the check stub. |

Calculation Method for Rounding

Click the prompt and, from the drop-down list, select the rounding method to use when calculating the amount to be paid in stamps.

None |

No rounding occurs. The amount of the Union Benefit/Deduction = (the regular hours * the regular rate) + (overtime hours * the overtime rate) + (the other hours * the other rate). The number of stamps awarded = regular hours + (the overtime hours * 1.5) + (the other hours * 2). |

Like Ben/Ded |

The amount of the Union Benefit/Deduction = the regular hours + (overtime hours * 1.5) + (the other hours * 2) rounded down to the nearest hour times the regular rate. The stamps awarded are calculated just like the Benefit/Deduction. |

All Hours |

The amount of the Union Benefit/Deduction = (regular hours * the regular rate) + (the overtime hours * the overtime rate) + (the other hours * the other rate). The number of stamps awarded = regular hours + overtime hours + other hours. |

Overtime X 2 |

The amount of the Union Benefit/Deduction = (regular hours * regular rate) + (overtime hours * regular rate* 2) + (other hours * regular rate * 2). |

Overtime X 1.5 |

The amount of the Union Benefit/Deduction = (regular hours * regular rate) + (overtime hours * 1.5 * regular rate) + (other hours * 2 * regular rate. |

Other Hours X 1 |

Rounding for Stamps as follows: All other hours are checked for double time,

and if so, are multiplied by 2. |

Amount

Use this field to enter a specific amount to be paid in stamps.

Click to process these entries and return to the Union Master Selection screen. |

|

Click to return to the Main Menu without saving changes. |

|

Click to delete the current record. |

|

Click to setup Other Hourly Rates for specific Hour Types. These rates will override the hourly rate entered on the Union Master Detail screen. For more information, see Other Hours Types. |

|

Click to return to the Union Master Selection screen without saving changes. |

Copy Union Master by Union screen

This screen is accessed from the COPY by UNION button on the Union Master Selection screen.

Company/Division Number

Accept the Company/Division used at login or click the Division Number prompt to make new selections from a list. The Company/Division Numbers are used for Inter-company transactions at the detail level.

Copy From

Union Number

Enter the Number of the Union to be copied.

Start Date

Enter the date (MM/DD/YYYY) the Union Master record went into effect, or click the icon to select from a calendar.

End Date

Enter the date (MM/DD/YYYY) the Union Master record ended, or click the icon to select from a calendar.

Copy To

Union Number

Enter the Union Number that you want to copy to.

Start Date

Enter the date (MM/DD/YYYY) the Union Master record went into effect, or click the icon to select from a calendar.

End Date

Enter the date (MM/DD/YYYY) the Union Master record ended, or click the icon to select from a calendar.

Multiplier

It is not absolutely necessary to use the multiplier. These amounts can be modified after the records have been copied.

The value entered will increase or decrease the amounts being copied.

For example, if the new rate is to be:

Increased by 8%, enter 1.080

Decreased by 8% enter .920

The original record (Copy From) remains on the system. Records may be periodically removed by clicking DELETE on the Union Master Detail screen.

Click to copy this Union's records for the specified date range, apply the multiplier, and return to the Union Master Selection screen. |

|

Click to return to the Main Menu without saving changes. |

|

Click to return to the Union Master Selection screen without saving changes. |

Copy Union Master by All Unions screen

This screen is accessed from the COPY ALL UNIONS button on the Union Master Selection screen.

Company/Division Number

Accept the Company/Division used at login or click the Division Number prompt to make new selections from a list. The Company/Division Numbers are used for Inter-company transactions at the detail level.

Copy From

The dates in the Copy From section auto-fill with entries made on the previous screen (Union Master Selection screen). Accept these dates, or modify them as necessary.

Start/End Date

If date-sensitive pay rates are being used, enter the date (MM/DD/YYYY) these rates went into effect, and the date it will expire. Click the icons to select from a calendar.

If date-sensitive pay rates are not being used, enter all 9s in the Completion Date field. The Start field will default to zeros.

Entering a date range that conflicts with that of an existing record will generate an error message. The conflicting date ranges must be resolved before continuing.

Copy To

Union/Class

Enter the Union and Class to which this information will be copied, or click the prompts to select from a list.

Start Date

Enter the date (MM/DD/YYYY) the Union Master record went into effect, or click the icon to select from a calendar.

End Date

Enter the date (MM/DD/YYYY) the Union Master records ended, or click the icon to select from a calendar.

Multiplier

It is not absolutely necessary to use the multiplier. These amounts can be modified after the records have been copied.

The value entered will increase or decrease the amounts being copied.

For example, if the new rate is to be:

Increased by 8%, enter 1.080

Decreased by 8% enter .920

The original record (Copy From) remains on the system. Remove old records by clicking DELETE on the Union Master Detail screen.

Click to copy this Union's records for the specified date range, apply the multiplier, and return to the Union Master Selection screen. |

|

Click to return to the Main Menu without saving changes. |

|

Click to return to the Union Master Selection screen without saving changes. |