Use this option to print the Payroll Register. After the Payroll Register has been printed, review the report carefully. If it is correct, proceed to Payroll Checks. If corrections are required, select Clear Process on the Payroll Processing menu, and then return to the Payroll Entry menu and use the Payroll Entry/Change option to make the corrections. After making the appropriate corrections, select the Payroll Proof and Payroll Register options again.

The register calculates from gross pay to net pay including: all taxes, benefits, deductions and net pay, and lists each check to be printed by the system as well as manual and reverse checks which are listed for information only.

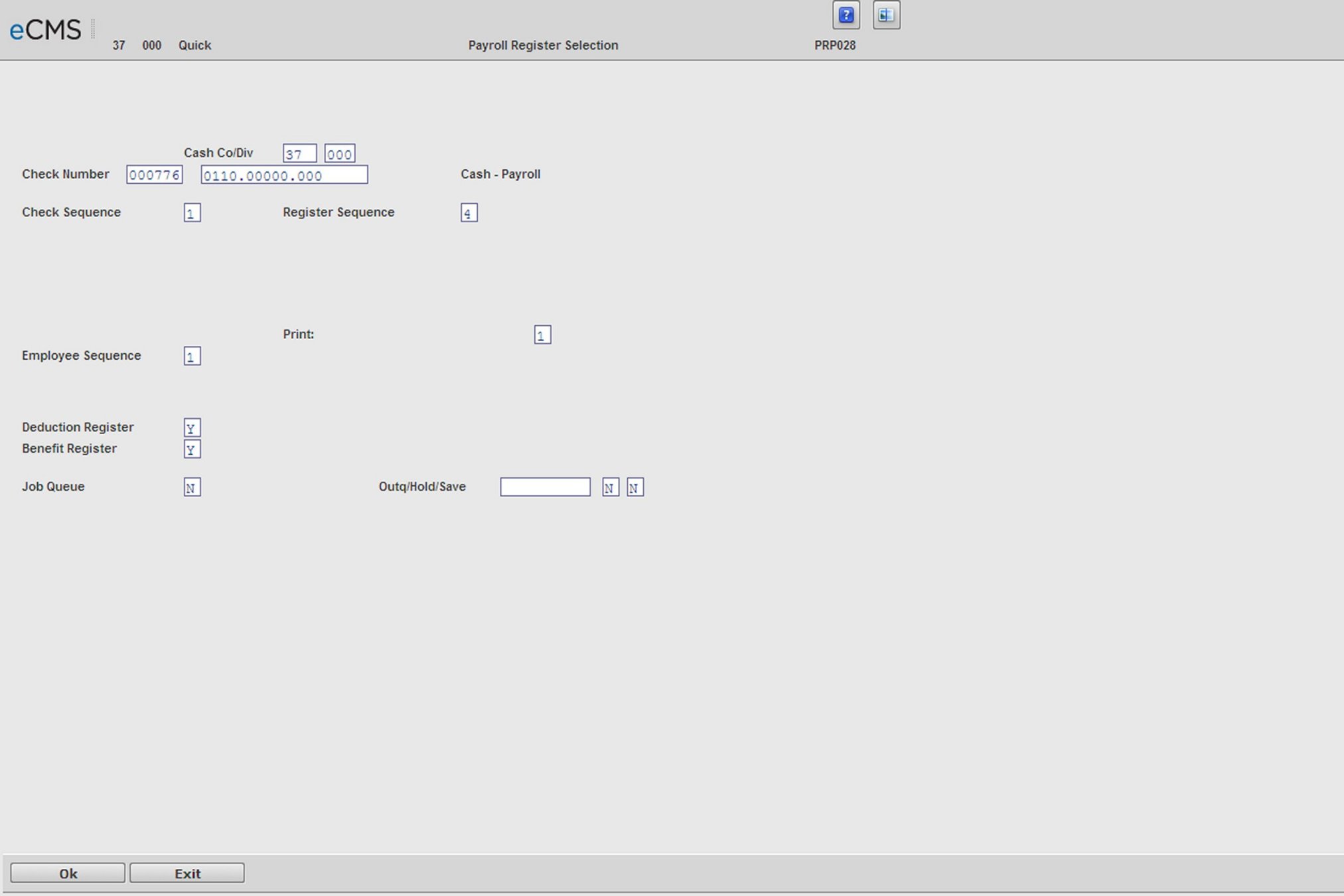

Payroll Register Selection screen

Check Number

The system tracks the next available check number to be used for each bank account in the Employer Bank Account file. This check number auto-fills for the first bank account. Press ENTER to sequentially display each of the bank accounts.

If the check number to be used for any of the accounts is different from the number displayed, enter the check number to be used on the first payroll check for each account.

If processing multiple companies, the selection screen displays again for each company to allow entry for a starting check number for each bank account in each of the companies.

When using “Check Number by System” in the Payroll Defaults, the system looks to Co 99/Div 999 Bank Account 99999999999999 in the Payroll Bank Account Master to find the first check number to assign. All check reconciliation for payroll will also be tied to the same account.

Check Sequence

Select one of the following codes to specify the sequence in which the payroll checks will print.

1 |

Last Job Entered / Employee |

2 |

Crew / Last Job Entered / Employee |

3 |

Department / Employee |

4 |

Employee |

5 |

Last Job Entered / Crew / Employee |

6 |

Crew /Home Union / Employee |

7 |

Crew Group / Employee |

8 |

Crew / Crew Grp / Employee |

Note: If daily time cards are selected to print (check print option), they will only print if this prompt is answered 1, 2 or 5.

Register Sequence

Enter one of the above codes to determine the sequence in which information is to be printed on the Payroll Register. The checks and register do not have to be in the same sequence. The register is usually in employee number sequence to make it easier to review at a later time, while printing checks in last job or crew sequence may make it easier to distribute them.

Employee Sequence

1 |

Print the register in employee number sequence within any of the other sequences chosen. |

2 |

Print the register in employee name sequence within any of the other sequences chosen. |

1 |

The last job number the employee worked on will print on the Payroll Register. |

2 |

The employee's assigned home department number will print on the Payroll Register only, not on the check. |

Note: This department number comes from the Employee Maintenance Master.

Deduction Register

Y |

Print the Deduction Register for review. The Deduction Register also prints during the Payroll Update process. |

N |

Do not print a Deduction Register for review. The Deduction Register also prints during the Payroll Update process. |

Benefit Register

Y |

Print the Benefit Register. |

N |

Do not print the Benefit Register. |

Job Queue

Y |

Submit this job for processing in the job queue (batch processing). |

N |

Process this job ahead of other jobs that are in the job queue (interactive processing). |

Click to process and print the Payroll Register. |

|

Click to return to the Main Menu without processing entries. |

If the Payroll Register is run before the Payroll Proof, the following message displays on the screen:

Payroll Proof is the next step to run.

This processing step cannot be run at this time

Click OK to return to the menu. Run the correct option.

Payroll processing cannot handle multiple job bank general ledgers run at the same time. Only the last record processed by eCMS for the bank G/L is used. To process separate checks for each G/L found on the job description, process each in a separate check run.

Benefit/Deduction Processing Order

If Process Arrears Deductions First = Y in default values, then

Exempt Payroll Deductions in Arrears

Exempt Payroll Deductions

Exempt Human Resources Deductions in Arrears

Exempt Human Resources Benefits/Deductions and All Benefits That Are Not Required to Match a Payroll Deduction

All Federal, State and Local Payroll Taxes

Non-Exempt Payroll Deductions

All Benefits Which Must Match a Payroll Deduction

If Process Arrears Deductions First = N in default values, then

Exempt Payroll Deductions

Exempt Payroll Deductions in Arrears

Exempt Human Resources Benefits/Deductions and All Benefits That Are Not Required to Match a Payroll Deduction

Exempt Human Resources Deductions in Arrears

All Federal, State and Local Payroll Taxes

Non-Exempt Payroll Deductions

All Benefits Which Must Match a Payroll Deduction