Workers Compensation Maintenance

A Worker’s Compensation record is required for each State in which payroll is maintained. This menu option is used to add, update and delete records in the Worker's Compensation file.

Access the screen by selecting Worker’s Comp from the File Maintenance menu.

Deleting a Worker's Compensation Policy record

1. Delete the individual Rate Code records.

2. Next delete the Policy record.

Property damage and general liability insurance are included in the same policy record.

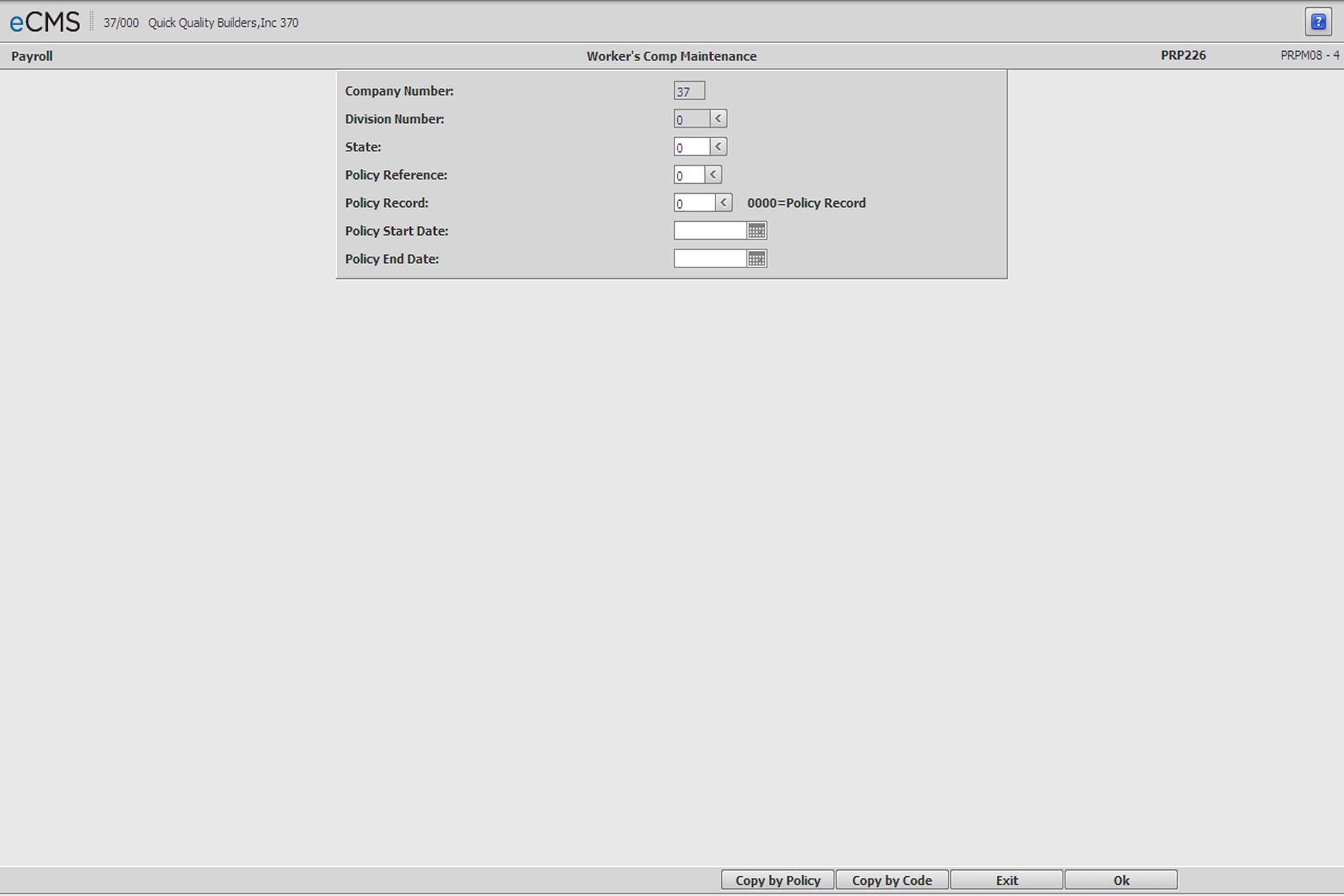

Worker's Compensation Policy Selection screen

Accept the Company/Division used at login or click the Division Number prompt to make new selections from a list. The Company/Division Numbers are used for Inter-company transactions at the detail level.

State Number

Enter the Number for the State covered by this policy, or click the prompt to select from a list.

The State Number must currently be set up in the Distribution Master file. For information on setting up State records Distribution Master Selection screen.

Refer to the State and Territory Numbers and Abbreviations List.

Policy Reference

Enter the Worker's Compensation Policy Reference Number assigned to this policy, or click the prompt to select from a list. Each policy must have a unique reference number.

Policy Record

Leave this field blank, or accept the default code (0), and then click OK to access the Worker’s Compensation Policy Detail screen, on which to modify the Policy End Date, Description, Experience Modifier, and Employee Deduction Number.

Enter a Policy Record and click OK to access the Worker’s Compensation Policy Rate Detail screen, on which to set Workers Compensation rates and limits.

Policy Dates

Start and End

If either of the following conditions apply, enter the Policy Start Date and Policy End Date for this Worker’s Compensation record:

Date-sensitive pay rates are used. (The system uses these dates for premium rate calculations).

The New York State Worker’s Compensation Act is applicable. (The system also uses these dates to fine the Commercial Limits.)

Note: If date-sensitive pay rates are not used, and the New York State Workers Compensation Act does not apply, enter all 9s in the Completion field.

Entering a date range that conflicts with that of an existing Worker’s Comp Policy record will generate an error message. The conflicting date ranges must be resolved before continuing.

Note: We recommend you print screens before deleting these entries and/or print a listing of the Worker’s Compensation file from the Payroll File Listings menu.

Worker’s Comp Rate Calculation Notes

Worker’s Compensation Policy calculations are based on a January to December period.

The system uses the week ending date to calculate a date for each of the 7 days of the week.

These dates are used in conjunction with the specified day number to calculate additions and deductions during payroll entry. By doing so, the system can get a new rate during the week for each record.

If the day number is entered as zero, the system will use day seven (7) to calculate the pay rates.

Click to process these entries and display either the Worker’s Compensation Policy Detail screen or Worker’s Compensation Policy Rate Detail screen. |

|

Click to return to the Main Menu without saving changes. |

|

Click to display the Worker’s Compensation Policy Rate Detail screen on which to copy Compensation rates by Rate Code. |

|

Click to display the Worker’s Compensation Policy Rate Detail screen on which to copy Compensation rates by Policy Number. |

Worker’s Compensation Policy Detail screen

The Workers Compensation Policy Detail Screen displays if the Policy Record field on the Worker’s Compensation Policy Selection screen was left blank, or contained the default value (0).

End

Enter a new End Date, if desired, or click the icon to select from a calendar. An error message will be generated if the new date conflicts with existing records, in which case it will be necessary to correct the date entry before proceeding.

Description

Enter up to 15 characters as a Description for this policy.

Experience Modifier

Enter the Experience Modification Rate. This only affects the Workmen's Compensation rate, not the Bodily Injury or Property Damage.

Employee Deduction Number

Enter the Employee Deduction number, from the Distribution Master, which will be used for the employee's portion of the Worker's Compensation liability if this applies.

Note: The Employee Worker's Comp deductions are calculated after Employee taxes.

Click to process these entries and return to the Worker’s Compensation Policy Selection screen. Make an entry in the Policy Record field, and click OK to display the Worker’s Compensation Policy Rate Detail screen. |

|

Click to return to the Main Menu without saving changes. |

|

Click to delete the current record. |

|

Click to return to the Worker’s Compensation Policy Selection screen without saving changes. |

Worker’s Compensation Policy Rate Detail screen

End

Enter a new end date, if necessary. If a new end date is entered, it cannot conflict with existing records or an error message is returned. You cannot continue until a valid end date is entered.

Description

Accept the current Description, or enter a new Description for this Worker's Compensation Classification Code.

Limit Type

Click the prompt and select the wage limit type, Annual or Pay Period, to be used when calculating Covered Wages.

Premiums will be calculated as described below for each of the Limit Categories.

Annual |

Premiums will be calculated based on the earnings per pay period until the employees Year-to-Date wages reach the Limit specified for each category. |

Pay Period |

Premiums will be calculated based on a system calculated wage limit per pay period using the Frequency code set up in the Employee Master file (Employee Master - Employee Data General screen). See the following example. |

Pay Period Limit example

The system compares the Pay Period Wage Limit to the Pay Period Gross Wages. Workers Compensation is then calculated on the portion of Pay Period Gross Wages that do not exceed the Pay Period Wage Limit.

Frequency State Master |

/ |

Pay Period Employee Master |

= |

Wage Limit |

P = $28,000 |

/ |

52 (weeks) |

= |

$400.00 |

Using the above example, if the employees Pay Period Gross Wages (Weekly) is $500.00 the system will apply the appropriate W/C Rate on $400.00. If the Gross Wages is 375.00, the system will apply the W/C Rate on the $375.00.

Limit Type

Click the prompt and select the wage limit, Annual or Pay Period, to be used when calculating Covered Wages.

Rates and Limits

Workers Comp |

The rate for this category is per $100 of covered wages, or per hundred hours of covered activity. $4.50 would be entered as 004500 (3 decimal places). |

Property Damage |

The rate for this category is per $100 of covered wages. $0.50 would be entered as 000500. |

Bodily Injury |

The rate for this category is per $100 of covered wages. $1.25 would be entered as 001250. |

Employee |

Enter the rate for this category. The rate is based on the number of HOURS worked rather than covered wages. The State Master has to reflect Rate/100 as 2 (Hours) for this to work properly. |

Enter a rate for each of the Limit categories based on the following table.

Limits

The Annual or Pay Period code and limits define how the Worker's Compensation Premium is to be calculated. If there is No calculation code entered here, the system will use the limits from the State Master file.

New York Commercial

The following fields display only if the NY State Code (330) was specified on the Worker’s Compensation Policy Selection screen.

Workers Comp Limit

The Workers Comp Limit field should be left blank if not applicable to the NY Construction Employment Limitation Law. Please refer to the New York Compensation Insurance Rating Board Bulletin for specifics.

This field is used for work performed on Commercial projects and is part of the calculation that is used to determine the premium amount due. The Workers Comp Code is entered in the Job Description file, for work performed and charged to a job, or the Payroll File Maintenance, Department Master for work performed and not charged to the job.

As stated in the NY Compensation Insurance Rating Bulletin

The limitation has a maximum of $900.00 per week plus ½ the difference between the Employees total payroll and the limited payroll.

This calculation is currently hard coded into the system. The limit amount and calculation may change each year based on the State of NY requirements.

A limit of $900.00 would be entered in this field if:

Commercial work is performed in the State of New York.

This record is for an eligible Workers Comp code.

Any and all other requirements are met.

The system will perform the rest of this portion of the premium calculation using the Workers Comp rate entered on this screen. Please refer to the New York Compensation Insurance Rating Board Bulletin for specifics.

Rate Differential- New York Only

Territory A

Territory B

Territory C

These fields display only if the NY State Code (330) was specified on the Worker’s Compensation Policy Selection screen.

These differential fields should be left blank if not applicable to the NY Construction Employment Limitation Law.

Enter the Territory Differential(s) as stated by the State of New York for this eligible W/C Code. This differential is used as part of the calculation for determining the

These three hard coded territories define the geographical locations of the work performed. Territories A & B have specific New York counties assigned to them by the State of New York, also hard coded on the system for reporting purposes. Territory C is for all other New York counties not otherwise assigned.

The Territory Codes A, B, or C are entered in the Job Cost File Maintenance, Job Description file, for work performed and charged to a job, or the Payroll File Maintenance, Department Master for work performed and not charged to the job. These files link the territories to a specific Job/Sub Job and Employee Department.

Sample Calculation

The following is an example of how the system calculates the premium amount:

Inputs

Code |

5445 |

Rate |

$11.14 |

Gross Weekly Wage |

$1300.00 |

Territory A |

135 |

Payroll Limit |

$900 |

Base Premium Calculation

Code 5445 Commercial $900 + (1,300 - 900)/2 = $1,100 x 11.14 + . . .$123

Differential Premium Calculation

$123 x .135 (Territory A) = . . . . . . . . .$17

Total Premium

$123 + $17 = . . . . $140

The above values are examples only. Please refer to the applicable State of New York publications/bulletins for details.

Click to process these entries and return to the Worker’s Compensation Policy Selection screen. |

|

Click to return to the Main Menu without saving changes. |

|

Click to delete the current record. |

|

Click to return to the Worker’s Compensation Policy Selection screen without saving changes. |

This screen is accessed from the COPY by CODE button on the Worker’s Compensation Policy Selection screen.

Company/Division Number

Accept the Company/Division used at login or click the Division Number prompt to make new selections from a list. The Company/Division Numbers are used for Inter-company transactions at the detail level.

Copy From

State

Enter the code for the state covered by this policy. Codes are listed in the State and Territory Numbers and Abbreviations List.

The State Number must currently be set up in the Distribution Master file. For information on setting up State records Distribution Master Selection screen.

Policy Reference

Enter the Worker's Compensation Policy Reference Number that you are assigning to this policy. Each policy for a company must have a unique reference number.

Rate Code

You can choose to copy a complete policy by leaving this field set to '0000' .

- or -

You can choose to copy an individual code by specifying a code and accessing the rate code entry screen.

Note: To copy a rate code to another date range, a valid policy record for that date must be set up or copied first.

Policy Start Date

The date (MM/DD/YYYY) the rates went into effect. Click the icon to select from a calendar.

Policy End Date

The date (MM/DD/YYYY) the rates expired. Click the icon to select from a calendar.

Copy To

Policy Start Date

Enter the date (MM/DD/YYYY) the rates went into effect for this Policy, or click the icon to select from a calendar.

Policy End Date

Enter the date (ERROR: Variable (Date_Format) is undefined. ) the rates expire for this Policy, or click the icon to select from a calendar.

Multiplier

It is not absolutely necessary to use the multiplier. These amounts can be modified after the records have been copied.

The value entered will increase or decrease the amounts being copied.

For example, if the new rate is to be:

Increased by 8%, enter 1.080

Decreased by 8% enter .920

The original record (Copy From) remains on the system. You may periodically remove the old records by using the Delete option on the Worker’s Compensation Rate Detail screen.

Click to process these entries and return to the Worker’s Compensation Policy Selection screen. |

|

Click to return to the Main Menu without saving changes. |

|

Click to return to the Worker’s Compensation Policy Selection screen without saving changes. |

This screen is accessed from the COPY by POLICY button on the Worker’s Compensation Policy Selection screen.

Company/Division Number

Accept the Company/Division used at login or click the Division Number prompt to make new selections from a list. The Company/Division Numbers are used for Inter-company transactions at the detail level.

Copy From

State

The Number of the State covered by this policy.

The State Number must currently be set up in the Distribution Master file. For information on setting up State records see, Distribution Master.

Policy Reference

The Workers Compensation Policy Reference Number assigned to this policy. Policy Reference numbers must be unique. Click the prompt to select from a list.

Policy Start Date

The date (MM/DD/YYYY) the rates went into effect. Click the icon to select from a calendar.

Policy End Date

The date (MM/DD/YYYY) the rates expired. Click the icon to select from a calendar.

Copy To

Policy Start Date

Enter the date (MM/DD/YYYY) the rates went into effect for this Policy, or click the icon to select from a calendar.

Policy End Date

Enter the date (MM/DD/YYYY) the rates expired for this Policy, or click the icon to select from a calendar.

Multiplier

It is not absolutely necessary to use the multiplier. These amounts can be modified after the records have been copied.

The value entered will increase or decrease the amounts being copied.

For example, if the new rate is to be:

Increased by 8%, enter 1.080

Decreased by 8% enter .920

The original record (Copy From) remains on the system. Records may be periodically removed by clicking DELETE on the Workers Compensation Rate Detail Screen.

Click to process these entries and return to the Worker’s Compensation Policy Selection screen. |

|

Click to return to the Main Menu without saving changes. |

|

Click to return to the Worker’s Compensation Policy Selection screen without saving changes. |